I have a strong preference for enterprise SaaS that can scale at all levels. I want to see recurring revenue, high gross margins, and improving operational costs (signs of operational leverage), having platforms & solutions that customers are flocking to and spending more (land and expand) and that I can see growing into something larger (signs of platform leverage). But I've made some exceptions around that adherence to SaaS & recurring revenue, both in consumer-facing companies I have owned in the past (especially with a razor/blade that is feeding a more scalable part of the business), and disruptive fintech platforms that have a transactional-based component that scales on usage/volume. Bill.com is one of those exceptions, as it bridges the gap between SaaS and transactional. The SaaS subscription (recurring revenue driven) part of the business is interesting, but, by itself, is not enough for me to be interested. What matters is the transactional part that it feeds.

At its core, Bill.com is back-office operational tooling, with a focus on small to mid-sized businesses (SMBs). The founder, CEO Rene Lacerte, is no stranger to back-office accounting and bill pay. He worked at Intuit from 1994, leaving in 1999 to found PayCycle – only to eventually be removed by the BOD in 2004 due to lingering growth (and the company eventually sold to Intuit in 2009). He then re-focused and founded Bill.com in 2006. Being in the back-office accounting is in his family as well – two distant cousins founded a tax-prep software company (Lacerte Software) that was sold to Intuit in 1998 (and that is still a product).

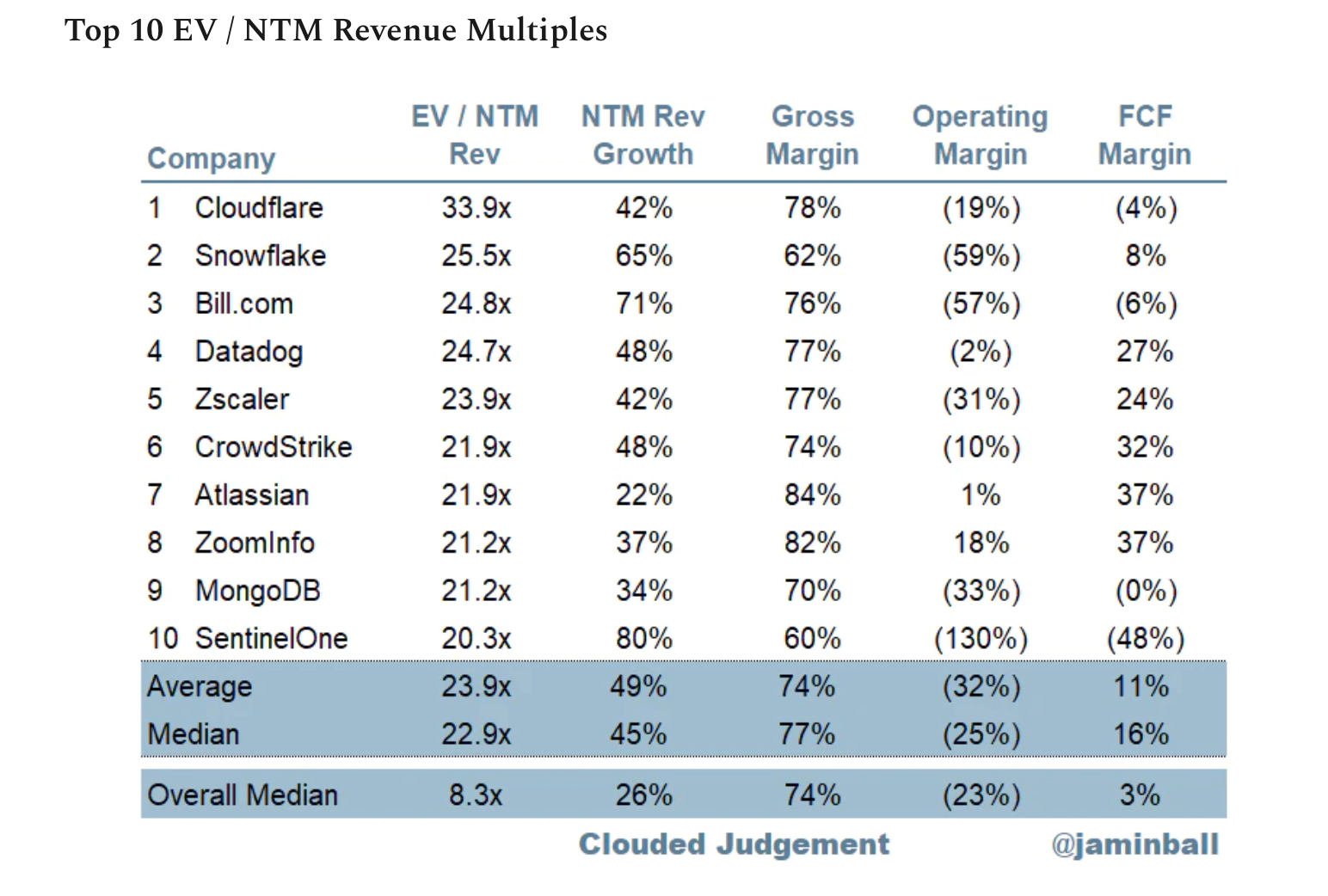

Bill.com IPO'd in Dec-19, and at the time, revenue was growing +57% (dropping from the +70%s) from an ARR of $140M, with gross margin of 74%, while NRR was only 110%. I wasn't that interested in a quick scan of the metrics at the time. And, since IPO, I had been mystified by Bill.com being at the "top of the valuation charts", as I hadn't really dived in to understand the company's mechanics.

In Nov-21 [when this article was written in my premium service], I finally got curious about why Bill.com remained so high on this list through 2021, with such a heavy amount of institutional ownership. After researching, I liked what I saw, started a position that has slowly built up the more I learn. The extremely high valuation remains, plus some added risks and well-funded rising competition.

The platform is...

An SMB back-office operational tool

At its core, Bill.com is a SaaS platform for SMBs to more easily handle their books. It has separate modules for businesses of all sizes to manage their cash flows – both for outflows to suppliers/vendors in Accounts Payable (AP), as well as inflows from customers in Accounts Receivable (AR). They have web and mobile app that helps businesses automate invoicing and payments end-to-end, and store any associated documentation. The financial benefit to SMBs is easy to see – it helps these businesses immediately see all their cash flows in one secure & auditable place, and not only allows them to see today's reality, but tomorrow's as well, by overlaying the calendar of payments and receipts expected in the future.

From the start, the platform has been focused heavily on integrations with popular SMB accounting software. Bill.com wants to serve as a seamless layer over all AP/AR processes and cash flows, to become an indispensable tool that sits over (not replacing) the accounting layer. It has two-way (bidirectional) sync capabilities in order to track AP and AR workflows and automates the tracking of clients, vendors, POs, invoices, and payments between itself and the accounting software. It has had an extensive partnership with Intuit to integrate into Quickbooks since 2016, and also integrates with other accounting software like Xero, and, moving more upmarket, Oracle NetSuite, Sage Intacct, Microsoft Dynamics, SAP, and FreshBooks. It also integrates with a variety of other back-office business services, such as Expensify, Hubdoc, Tallie, and Tax1099.

Tiers of pricing in the SaaS platform:

- Essentials, $39/user/mo, for either AP or AR, but must manually import/export to accounting software

- Team, $49/user/mo, to integrate that AP or AR with Quickbooks or Xero

- Corporate, $69/user/mo, to get both AP & AR

- Enterprise (unknown price) integrates w/ larger mid-tier accounting packages & SSO, plus gives access to API & premium support

Marketing is all about having a paperless office, and getting away from manually having to track every transaction (or worse, doubly track it across multiple unconnected systems). It helps manage and automate the AP/AR workflows – across invoice submission, approval, & sending payment in AP, and entering invoices, sending them to clients, & receiving payment in AR. In 2019, the platform added AI/ML capabilities, dubbed the Intelligent Virtual Assistant (IVA), to automate the extraction of data off of submitted paper or PDF invoices, auto-categorize that data, and help automate the workflows (such as automatically creating bills from received PDF invoices in your inbox, only prompting for missing information or spotted errors before advancing straight to the approval stage). From the announcement blog post, it sounds similar to smart OCR capabilities (like UIPath allows for over legacy software):

So what makes IVA so intelligent? IVA is artificial intelligence (AI) built into the Bill.com platform. Simply put, AI is powerful computing that “learns” to perform tasks without being explicitly programmed to do so. AI uses statistical algorithms to improve over time based on past and present input and outputs, without reprogramming. This AI is how IVA learns over time, getting faster and better at recognizing invoice formats and extracting data more accurately.

But to become intelligent, IVA had to first be trained - trained how to recognize invoice data and trained how to improve over time. With any AI, the larger the training dataset, the smarter the machine will be on day one and the faster it will learn. Fortunately, Bill.com has one of the largest training datasets around. IVA was trained with over 10 years worth of invoices that have been processed through Bill.com. That equals hundreds of millions of invoices, so IVA usually knows what to do with the next invoice it sees.

With artificial intelligence like IVA, the system is not only designed to intelligently improve over time, IVA will also do more in the future with Bill.com computing power, capabilities, and data. You’ll see things such as automated analysis and reporting, and IVA become more responsive based on your input and feedback.

Bill.com claims its platform's automations in the AP/AR workflow turn what is typically 3 days a month of manpower into 1 hour. Clients are reporting that they no longer need a full-time employee to manage AP, showing how the Bill.com subscription easily pays for itself. And a survey of customers in 2019 showed that the AR system helps deliver 2-3x faster payments.

The interesting (and sticky) approach that Bill.com has taken with its AP/AR modules is how it has structured its platform to expose other GTM motions beyond direct sales, which allows its partners to bring in more and more subscriptions as they grow. [There are multiple nested relationships to understand here. To make the terminology clear, I'm going to call Bill.com's SMB subscribers as "customers" and those customers' customers as "clients". I'll also call the partners' customers "clients", but in that situation, they are both the partner's and Bill.com's customer. (Now you can see why I am trying to differentiate these layers!)]

- The platform can serve as a multi-tenant layer for accounting firms to use over their clients (who must become a Bill.com customer). This allows major accounting firms to have any of their clients use the platform's AP & AR capabilities, in order to more easily provide their services and oversee their clients' cashflows in a centralized console. This tactic has proven wildly successful – as of FY20, they have 5k accounting firms as partners, including >80% of the top 100. In Nov-20, they announced that they expanded this multi-tenant capability beyond accounting firms, by adding a new focus on the clients of wealth mgmt firms as well.

- The platform can serve as a white-label solution for financial institutions (FI) to embed AP/AR & bill pay capabilities into their own offerings for SMB clients (who get counted as Bill.com customers). BofA's Merrill Lynch embedded the AP modules in 2014. JPM/Chase integrated AP in 2017. First National Bank of Omaha (FNBO) integrated with AP & AR in 2018. AMEX embedded AP into Vendor Pay in 2019. Most recently, in Dec-20, Wells Fargo embedded AP into Bill Manager. Bill.com has now landed 5 of the top 10 US banks, and many other super-regional & regional banks. These white-label solutions also extend to their other non-bank partners, like accounting software – in Aug-20, they extended their partnership with Intuit to embed their AP solutions into Quickbooks Online Access for bill pay.

I want to stress how both of these capabilities provide a funnel for new customers to enter through, and make the entire platform incredibly sticky from the huge benefits to those partners. These partners are using the platform as operational building blocks needed to serve their own SMB customers (especially for bill pay), and are then continuously driving more customers (and more bill pay) to Bill.com. Via multi-tenancy and white-labeling, the platform goes from a critical operational tool for its direct customers to being deeply embedded into its partners' operations. And this likely explains why financial institutions have been so involved in their early funding. On the flip side to these heavy partnerships, when a major partner leaves, it takes its customers away in one fell swoop – when one left in late 2018 (per the S-1), they lost 5k customers.

There are some indirect benefits to this extensive partner ecosystem. These large financial institutions require that Bill.com submit to extensive & frequent security audits. And fraud can occur – though fraud loss rates were < 1bps of TPV for FY18 & FY19, per the S-1. They maintain SOC and NIST standards, and are continuously audited by 3rd parties as well as major strategic partners. As a SaaS service, they stress they are highly redundant, having full-site failover since 2017 between 2 primary data centers, with backups hosted in a 3rd. They mentioned in their S-1 that they have begun transitioning all production infrastructure to AWS (though I don't recall any updates on that since).

Regardless of the multiple impressive GTM motions opened up, the SaaS portion alone has never been at hypergrowth, with subscription revenue growth hovering between mid 30-40%s, which further dropped to 31-32% in Q3-Q421. However, subscription revenue just had a huge rebound, jumping to 39% and 51% organically in the last 2 quarters. Customer growth did get a boost during COVID (from +20% to +28%) but is now slowly dropping back to the low 20%s. I should note that RPO is pretty flat. Most of their SMB customers have monthly or annual subscriptions – not multi-year, so I think it better to watch Current RPO (within a year), which has been on the rise – it went from +49% last year ($18M) to +140% this year ($43M). [Since this was written, they switched Current RPO to report the next 2yr period instead of NTM, which is not as helpful.]

A payment layer

Alongside the SaaS component, Bill.com added bill payment features in 2009. This allows them to monetize the payment flow, by acting as a middle-man between their SMB customers and those customers' suppliers and clients. For physical invoices, they can receive paper or digital invoices from suppliers (AP), or print & mail or send digital invoices to the clients (AR). For physical checks, they can issue them through the mail (AP), or receive them from their customers' paying clients (AR), and have long supported ACH (akin to a digital check) between parties. Bill.com has now built up a network of 3.2M "network members", aka the suppliers that are getting paid. It tracks the information of vendors and allows them to interface with the platform, so that all of its clients using Bill.com are easily hooked into that vendor's preferred payment type.

Expanding the payment capabilities has been a huge focus, as they strive to exploit all other B2B payment types. In 2018, they added international (cross-border) payments, with a huge list of countries supported. In Apr-19, they partnered with Mastercard to provide virtual credit card capabilities, to pay a supplier via CC from any funding source. Instant Transfer was piloted in Nov-20, via The Clearing House's Real-Time Payments (RTP) network (which supposedly ~50% of US banks are a part of). In the Feb-21 earnings call, mgmt stressed that Instant Transfer will be focused on SMBs that aren't big enough to accept CCs, but want faster receipt of funds – and it only takes a 1% fee, vs the 3.5% of a CC processor or Stripe, while being way faster than ACH and check.

Being a middle-man in slow forms of payment allowed Bill.com to profit on the float (aka "interest on funds held for customers") that they held in the interim while waiting for a check or ACH to clear. They have separated out interest/float as a segment, which has lately been affected by the lowering Fed rate. This has impacted the top line and gross margin (as this was nearly 100% margin) as it has fallen. To highlight the impact, it was 22% of revenue in Q319, rapidly falling to 12% in Q320, then 2% in Q321. It now contributes 1% of revenue. However, it seems that this portion of revenue hasn't really mattered to the Bill.com story for a while, as the rise in faster and faster transaction methods has greatly impacted how long they hold funds. I think watching the accelerating growth in transactions is much more important, so I ignore float contribution altogether now. [Now that Fed rates are increasing in 2022, this has now become a tailwind.]

Their monetization of payments being made through their platform is a 2-sided network, with Bill.com acting as the middle man between its SMB customers either 1) getting paid by their clients, or 2) paying their suppliers/vendors. So not only can Bill.com monetize their SMB customers in the middle of those two sides, but also the other side of those transactions as well. In particular, they are beginning to monetize that network of suppliers that want to be paid faster, in a preferred way, or even directly in their native currency. They have had efforts over the past few quarters to work more and more with suppliers in their 3.2M member network, both to find the US suppliers that want to accept CC payments or faster ACH or check (for an upcharge), as well as international vendors that want to accept international payments in their native currency (for an upcharge). [They talk in earnings calls about using AI/ML for this effort – which is table stakes anymore in fintech, and not really something to crow about repeatedly. But I think it highlights they are a data-driven organization that is good at leveraging their existing data into fueling these new directions.]

So now, they facilitate payments in a variety of ways, both with their SMB customers, as well as now with the supplier network that is getting paid:

- Send and receive ACH Payments, including Faster ACH for an upsell.

- Mail and receive physical checks in a more secure way (as it never exposes customer bank info), including Faster Check for an upsell.

- Receive CC payments, or send virtual CC payments (from bank acct to CC).

- Cross-border payments via international wire, for a flat fee in USD, or a variable fee for local currency.

- Instant Transfer (real-time payments to bank accounts) via The Clearing House's RTP, which has supposedly ~50% of US banks participating.

In the recent past, they mentioned they are partnering with Stripe to add debit cards to Instant Transfer, which opens up the capability more fully.

Q221 earnings call: So one of the things that we're investing in right now is adding debit rails. And when we add debit rails, that will get us to all business accounts will have the ability to accept the real-time payment if they want that. And we're going to do that with an integration through Stripe. So that's an example of something that I would say over the coming quarters that we're working on.

Q321 earnings call: In addition, we've been piloting our real-time payments product, which we branded Instant Transfer. As we mentioned last quarter, we are building an integration with Stripe that will expand the reach of our Instant Transfer product by enabling vendors to receive funds via debit cards. The Stripe integration will be generally available this quarter as time payments to nearly all of our more than 2.5 million network members bank account.

No further updates (on Stripe or debit rails) were provided in the 2Q since, however.

More recently, in Oct-21, they partnered with Marqeta to provide single-use virtual cards to its customers' employees, which allows for dynamic spend controls on where or how the cards are used. In the PR, it stresses that this is focused on FI partners.

This new partnership assists Bill.com’s business goals to digitize payments and streamline accounts payable workflows for financial institution customers. ... "We believe that our customers deserve innovation, which is why we’ve partnered with Marqeta and their flexible card issuing platform to deliver this new offering to serve our financial institution partners and their customers,” said René Lacerte, Bill.com CEO and Founder.

However, a related blog post makes it sound a bit different:

We’ll be working with Bill.com to allow its customers to pay suppliers and accounts payable with single-use virtual cards, which help make cash flow management more seamless and shrink the time for small businesses between earning money and getting paid. We’ll also help power new expense cards for their customers, allowing businesses to issue cards to their employees and utilize dynamic spend controls to designate where and how the cards can be used.

The blog post sounds like it relates to Divvy, which IS using Marqeta – but the PR makes it sound like it is for FI partners. [I can't tell if this was one partnership with Marqeta or two.]. Either way, Bill.com is moving more upmarket with this partnership, into mid-size customers that need to manage spend across a lot of employees.

Acquisitions

Divvy

Divvy is a platform and service for managing employee spend, through the use of physical and virtual (one-off) CCs. They allow employers to directly control the spending use of these employee cards, including where and how much can be spent. It provides companies visibility, control, and insight over CC spending by combining expense management features with budgeting – all for free. What Divvy (and competitors Ramp and Brex) do is provide these CC card & platform capabilities for free to qualifying customers, in order to then take a cut of the interexchange fee of all the spend going through the cards (split with the issuing bank and bill pay processor).

These services aren't taking that much risk, as they provide a spend card that is paid back monthly (or more frequently) directly from the company's bank account – they are not a credit card that carries a balance. In essence, it is a "smart corporate card" that lets companies spend smarter and better manage budgets and cash flow. Not only are these platforms and cards free to use, but they also have rewards programs similar to formal business CCs from Chase, Amex, and Citibank.

Bill.com announced on May 6 they were acquiring Divvy, and it closed on June 1. (So Q421 had 1 month of Divvy, and Q122 was the first entire quarter.) It was a $2.5B deal – $1.88B in stock, $625M in cash, and added 400 employees. This acquisition has many benefits for Bill.com:

- Expands platform with spend management capabilities, including expense, budgeting, and reimbursement capabilities – features that are more desirable the more you move upmarket into mid-market (that have a larger number of employees to manage).

- Expands the payment monetization into physical and virtual CC cards, that have attractive monetization rates over a greater amount of corp spend. This expands their payments platform to spend being made outside of their supplier network. (Though I imagine they will be tying this platform into their supplier network more closely as well.)

- Grabs on to a huge new wave in "smart corporate cards" that have an attractive financial model, with customer allure (free! better rewards!) that is experiencing huge growth. This also brings Bill.com closer to the immediate competition, as they move towards Bill.com with AP workflow and bill pay features. [None are yet showing signs of moving into AR – they are focused on outflows not in.]

When you sign up, Divvy gives you a line of credit over all your employee cards. This review stated they grant a line that is 30% of your avg monthly deposits. From there, you must spend $5K or more per month to remain free. [See the FAQ for more details, or this review from PointsGuy, a well-known corporate CC review site.]

It seems that Divvy's physical and virtual cards started with Mastercard, which was provided by WEX Bank. At some point, it shifted its cards to Visa through a Cross River Bank & Marqueta partnership. (I am not sure when that occurred, but all branding is now Visa, and Internet Archive isn't cooperating to look at past web pages. Perhaps it shifted when the Marqeta partnership was announced in Oct-21.) Beyond that, Divvy uses MVB Bank for its bill pay features, per its terms of service, but I imagine that will get folded quickly into Bill.com's platform and underlying partners.

At acquisition, Divvy reported 7.5K customers, a $100M annualized run rate growing +100%, and $4B in annual TPV. By Q222, Divvy had 15.5K customers. It provided $1.9B in TPV from 5.3M tx in the latest Q.

Invoice2Go

Invoice2Go (which I will abbreviate to "Inv2Go") is a wildly different service. Based in Sydney, Australia, and Palo Alto, they provide a mobile-first platform that helps smaller businesses and sole proprietors manage their everyday operations. They help these smallest of small businesses create an online presence, manage customer relationships, develop estimates/quotes, send invoices, and accept payments.

Bill.com announced on July 19 that they were acquiring Inv2Go, and it closed on September 1. (Q122 had 1 month of Invoice2Go.) It was a $625M deal – 75% in stock, 25% in cash, and added 100 employees. This acquisition also has many benefits for Bill.com:

- It strengthens their AR product, with additional estimate/quote & invoicing capabilities and a rich mobile-first app and platform.

- It bolsters its international presence across employees, customers, and suppliers (member network). Inv2Go has 226K customers across 150 countries, with offices in Australia and US. Bill.com has been focused on monetizing international payments to suppliers outside the US, but hinted in their Feb-21 earnings call that this acquisition is a precursor to expanding into international customers as well.

- Inv2Go's platform created $25B in invoices over the past year – however, the payment opportunity has been largely untapped by Inv2Go. In the one month they contributed to Q122, Inv2Go reported $100M in TPV, on only 100K tx. Of course, these smaller & single-person businesses will result in way less payment volume and size (and may begin to lower the revenue per tx), but it provides a fresh area for payments to penetrate further into.

Perhaps new payment rails might be explored as well. Beyond accepting CC and Paypal payments from clients, Inv2Go reports on their website that they were adding instant payments, installment payments, and financing features. I imagine this will tie more closely into Bill.com payment rails soon (though that doesn't feature installment payments as of yet – perhaps Inv2Go had planned to tie into Affirm or a similar BNPL).

Beyond invoicing and client payments, Inv2Go has payroll capabilities that tie into the Gusto HR/payroll service, plus ties into Zapier for integrating with just about any other business operations package. Mgmt hinted in the latest earnings call that payroll is another area they could explore going forward, but for now, Bill.com is fully focused on completely integrating Divvy and Inv2Go into a single holistic back-office platform. (From there, adding on other capabilities like HR/payroll seems inevitable.)

CEO on Q122 earnings call: "And then ultimately, we do look at HR and payroll as, again, part of the overall one-stop shop. So lots of ways to kind of think about where we can extend. But first and foremost, we're going to continue to focus on making the 3 businesses work together as one, and to have the one-stop shop that we've been building over the last decade or more."

Competition

They maintain that the majority of competition is manual processes (aka greenfield). There are larger players in this space, obviously, that focus on larger enterprises, as well as niche plays in SMB that focus on specific parts of the back-office stack (document mgmt, workflow mgmt, AP workflow automation, AR workflow automation, or bill payment).

The ones I feel are worth watching are the upstarts coming at them from the Divvy side of things – this new breed of service that is issuing smart corporate cards and then adding in bill pay and AP workflows. (However, none of these are entering in the AR side.)

- Brex provides smart corporate cards, expense tracking, spend mgmt, bill pay, instant receive, and accounting software integrations. It provides unlimited ACH and int'l wires for free, and has multi-tenant capabilities for accountants and bookkeepers. They are powered by Mastercard via Emigrant Bank & Fifth Third Bank, per their card terms & conditions, while banking is provided via partner banks including LendingClub Bank & JPM Chase. Per this review, Brex requires a $100K bank balance to qualify. They had a Series D in Apr-21 that valued them at $7.4B, and a future round is rumored at $12.3B. Investors include Ribbit, DST, Greenoaks, Peter Thiel, and Max Levchin (the CEO of Affirm).

- Ramp provides smart corporate cards, expense tracking, workflow automation, and accounting software integrations, plus has recently added bill pay in Oct-21. They partnered with Marqeta to issue Visa physical and virtual one-off cards [See their case study on Marqeta's site. The blog post above for Marqeta's Bill.com partnership pointed to Marqeta's Expense Mgmt solution, which is what Ramp also uses.] One review mentioned higher price tiers for enterprise features – but pricing seems to all be free now. A Forbes review stated they require a $250K balance, however, I saw a review in Sep-21 that compared them to other business credit cards (including Brex) that stated a $75K bank balance to qualify. In Aug-21, they had a Series C that valued them at $3.9B. Investors include a lot of VCs I am used to seeing invest in SaaS & data infrastructure, like Altimeter, Redpoint, D1 & Coatue, as well as Stripe.

- Airbase provides smart corporate cards, bill pay, expense & reimbursement tracking. Pricing is free for smaller companies, but prices on higher 2 tiers (100+ empl, and enterprise) are hidden. They had a Series B in Jun-21 at a $600M valuation, so are clearly a lot smaller than the other two – but they seem to appear often in comparisons.

Divvy has pointed out its differences with Brex and Ramp. Ramp has returned the favor against Divvy and Brex, and Brex against Ramp. Regardless of the past comparisons, I think Divvy clearly has a differentiated feature set now that it will be integrated into the entire Bill.com platform. Divvy bolts on a great feature set for spend management.

Putting it all together

Like peanut butter and chocolate, the SMB subscription and transactional portions combine into a greater whole. The subscriptions feed the transactions to make the entire company become a greater success, and transactions are growing faster than subscriptions as they find more ways to scale and profit off of being a centralized payment platform.

As of their IPO in Dec-19, they had 81k customers, 1.8M network members (suppliers), and 180M documents/bills/invoices stored. In the over 2 years since, it has now grown to 135K customers, paying into 3.2M network members (last reported in Q4 at +28% YoY).

Revenue growth was slowing from 70%s to 60% to 50% in FY19 and into FY20, only to hit the pandemic (that likely heavily impacted SMBs) – yet growth only dropped 45% to 33% to 31% before rebounding. Core Revenue is their subscription + transaction revenue – aka everything but Interest on held funds (float), which is going away and being replaced by massive scale of transactions. The loss of Float is what really impacted growth in that inopportune time – Core Revenues never dropped below +53%, while the top line dropped to +31%! There was a concurrent impact of loss of float and the pandemic – but then the transactional revenue really started going into high gear with new monetization initiatives (instant transfer, international wires, paying by virtual CC).

Financials have become a bit more muddled over the last few quarters, especially the operating and cash flow margins. Q421 had one month of the Divvy acquisition. Q122 had an entire quarter of Divvy, and one month of the Inv2Go acquisition. But looking at just the organic numbers, Bill.com is showing a continued reacceleration out of the initial impact of the pandemic.

| Q420 | Q121 | Q221 | Q321 | Q421 | Q122 | Q222 | |

|---|---|---|---|---|---|---|---|

| Revenue YoY | +33% | +31% | +38% | +45% | +61% | +70% | +81% |

| Core Revenue YoY | +54% | +53% | +59% | +62% | +73% | +78% | +86% |

| Sub Rev YoY | +40% | +36% | +34% | +31% | 32% | +39% | +52% |

| Tx Rev YoY | +81% | +83% | +97% | +112% | +138% | +128% | +121% |

| Tx Rev QoQ | +10% | +26% | +34% | +14% | +23% | +21% | +30% |

| Customers QoQ | +7.3% | +5.6% | +5.4% | +5.9% | +4.8% | +4.6% | +6.5% |

| TPV YoY | +26% | +31% | +40% | +45% | +64% | +63% | +62% |

| Num Tx YoY | -1% | +10% | +16% | +19% | +46% | +35% | +36% |

| Rev per Tx | $2.71 | $2.94 | $3.57 | $4.07 | $4.40 | $4.97 | $5.80 |

Per the latest 10-Q, total revenue was $147.5M (+201% YoY) from SMB/Accounting customers, and $7.9M (+139%) from FI (bank) partners. I am a bit surprised how small the FI partner portion is – it makes for good headlines, but really isn't what drives revenue.

Customer growth remained steady in FY20-21 (+4.5 - 6% QoQ), after a jump in Q420 (+7.3%) in the early stages of pandemic. No customer accounts for over 10% of revenue. It shows how much SMBs are embracing digital transformation to get away from error-prone manual processes in the back-office. But, beyond that, expense tracking in particular is having massive success. Divvy has been having huge revenue & customer growth since acquisition. It just had +188% standalone growth in Q222, as it has gone from 7.5K custs to now 15.5K over the last 3Qs! Inv2Go brings in 226K new small business & sole proprietors on the lower end of the market.

Transactions got a huge boost in Q1-Q221 (Jul-Dec 2020), which shows how SMBs made a huge shift into digital payments as a response to the pandemic. Transactional count & volume have been massively accelerating since, though Q2 provides a tougher comp this next Q. Beyond the organic numbers above, Divvy is now doing 5.3M tx for $1.9B in TPV, while Inv2Go has only 100K tx for $100M in TPV (very under-penetrated) in their first month of contribution. All the while, the organic revenue per tx has been increasing – but I expect any penetration into Inv2Go's base to eventually temper that.

Gross Margin is up +8pp YoY to 85%, which seems to have been bolstered by the Divvy acqusition. Operational margin has been slowing trending towards positive over the past few years – but costs have now exploded the last 2Qs with the acqusitions. Cash flow margins are all over, and don't seem that helpful a metric to track. In Q421 they massively swung to the positive, only to swing back the other way in Q122. This wasn't addressed in the conference calls, but the 10-Q stated that swing was "due mainly to the increase in payments for costs of our services and operating expenses". Something to watch, especially with all of this being muddled by the 2 new acquisitions.

In cash flow from investments, part of the $453M spent in Q1 was the cash outlay for Inv2Go ($164M), but the 10-Q stated the rest is due to "increase in purchases of corporate and customer fund short-term investments, ... and increase in acquired card receivables". With Divvy, they now have costs in S&M for CC rewards, plus have added risk in having to cover the CC spend being facilitated by their banking partners – which I feel is not a particularly large risk, given they have a direct view into the bank account (and financial well-being) of their SMB customers, and then auto-debit from it on a set schedule. For more on the Divvy model, its banking partners, and risk, see the "Our Receivables Purchases and Servicing Model" in the Q1 10-Q. To recap it quickly:

When a business applies for a Divvy card, we utilize proprietary risk management capabilities to confirm the identity of the business, and perform a credit underwriting process to determine if the business is eligible for a Divvy card pursuant to our credit policies. Once approved for a Divvy card, the business is provided a credit limit and can use the Divvy software to request virtual cards or physical cards. ... We are responsible for all fraud and unauthorized use of a card and generally are required to hold the bank harmless from such losses ... Pursuant to our agreements with the banks, we are obligated to purchase the participation interests in all of the receivables originated through our platform, and our obligations are secured by cash deposits. ... On average, our spending businesses pay their statement balances in approximately 20 days.

Conclusion

Bill.com is:

- A SaaS platform for AR and AP workflow automation for their direct customers

- Multi-tenant SaaS platform for partners ... accountants and now wealth managers

- White-labelled embedded platform for large partners ... top banks in US use for SMB clients

- Payment system over all cash flows in and out.

Payments are the magnifier here.

They claim their TAM has 6M+ SMBs in the US, and ultimately 20M+ internationally, and, as they move downmarket, 26M+ sole proprietors in the US, and 50M+ internationally. The growth in subscription revenues remains impressive - but is not hypergrowth on its own. However, the platform is the entry point into transactions, as customers adopt a better back-office tool and then utilize more and more digital payments from it. All those multi-tenant partners are putting more and more customers onto this plaform along with direct sales efforts. It is a two-side payment network that serves their own customers, plus serves the underlying clients that pay, and suppliers that are paid. This creates a virtuous cycle - as the suppliers are now starting to become monitized, and, in turn, might then lead them to become direct Bill.com customers as well.

They are now going up market more into larger mid-market businesses, adding in capabilities (like PO tracking) and accounting software integrations, and now adding in Divvy to help manage employee spend via physical and virtual CCs. They are also now going down market into smaller businesses & sole proprietors with the addition of Invoice2Go, which gives a new direction for payments to penetrate, plus gives Bill.com a strong base to expand more into international.

This company has an extremely high valuation for a reason. The effect of the Float is no longer masking things and transactions are now exploding, so the market has a clearer view into the mechanics of this company. It is now monetizing payment flow more, while other new levers of growth are being explored. Divvy is expanding their product line while its own growth is exploding (now adding $48.7M in revenue per Q, vs the $100M annualized run rate they stated at acquisition!). Inv2Go is also opening up new horizons downmarket and internationally.

Add'l Reading

This interview of the CEO in Forbes from Dec-20 has some of the backstory on the CEO, and how this business was built in a slow-and-steady way in the early years (to the likely chagrin of early investors). They don't seem to have a problem with finding growth now!

Who are all these banks behind fintech payment platforms? A16Z had a good chart from Jun-20 on who powers the back end (a bit outdated but worthy of a look), plus had an essay on the challenges in payments. [Looking forward to seeing fintech platforms like Stripe and Modern Treasury go public, too.]

This post was originally written in November 2021, and brought up to date with the Q4 numbers in Feb-22. Sign up for Premium if you want in-depth coverage of Zero Trust & SASE Networks, Edge Networks, Data & Analytics, Observability, Dev Tools, and Enterprise SaaS, including companies like Zscaler, Cloudflare, CrowdStrike, Datadog, and Bill.com.

- muji