Samsara is doing well in this rockier economic environment and in the stock market – so much so that it has risen into the top 10 SaaS valuations lately at Clouded Judgement. Today let's cover their architecture and what they provide. A later follow-up [paid] covered their investment picture over the last few quarters and their recent Beyond conference and IR day.

Samsara

Samsara is a turnkey cloud platform built for tracking and analyzing data from physical operations. Not office-focused business operations (S&M, R&D, G&A) or IT operations (DevSecOps), but physical ones – businesses that have vehicle fleets for field work or delivery of goods, or equipment fleets for field work, or remote work sites and distribution methods requiring logistics. Mgmt likes to continually mention how these types of companies represent 40% of global GDP.

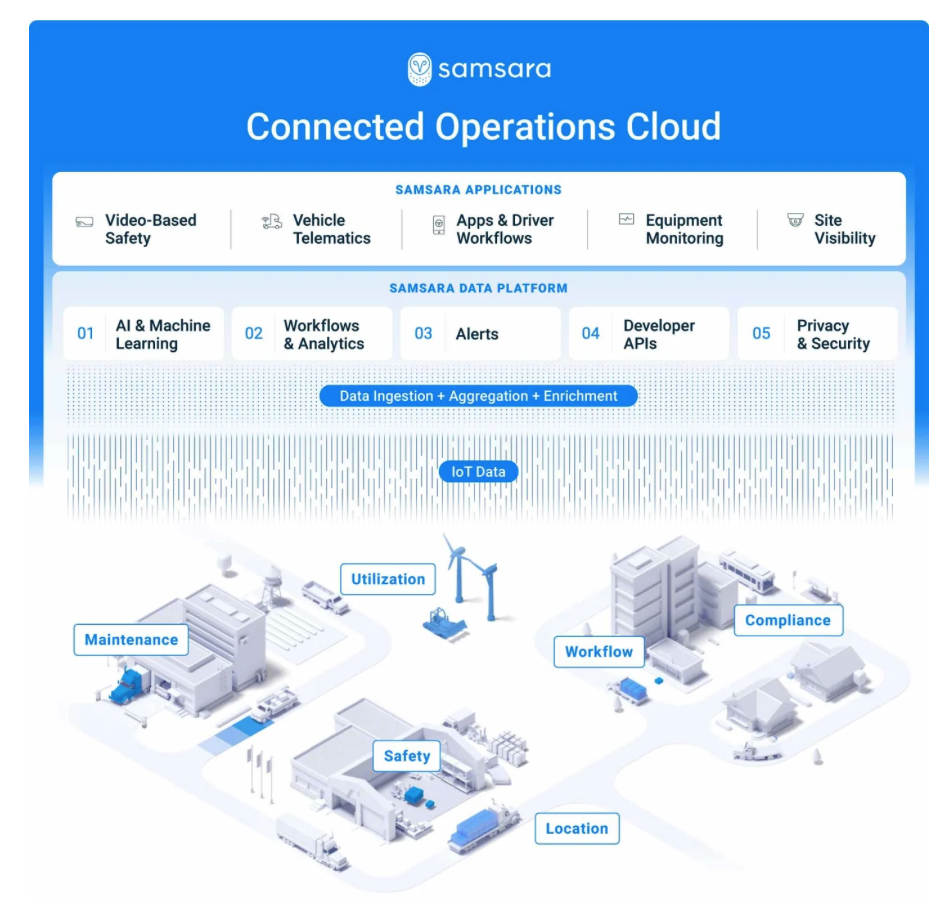

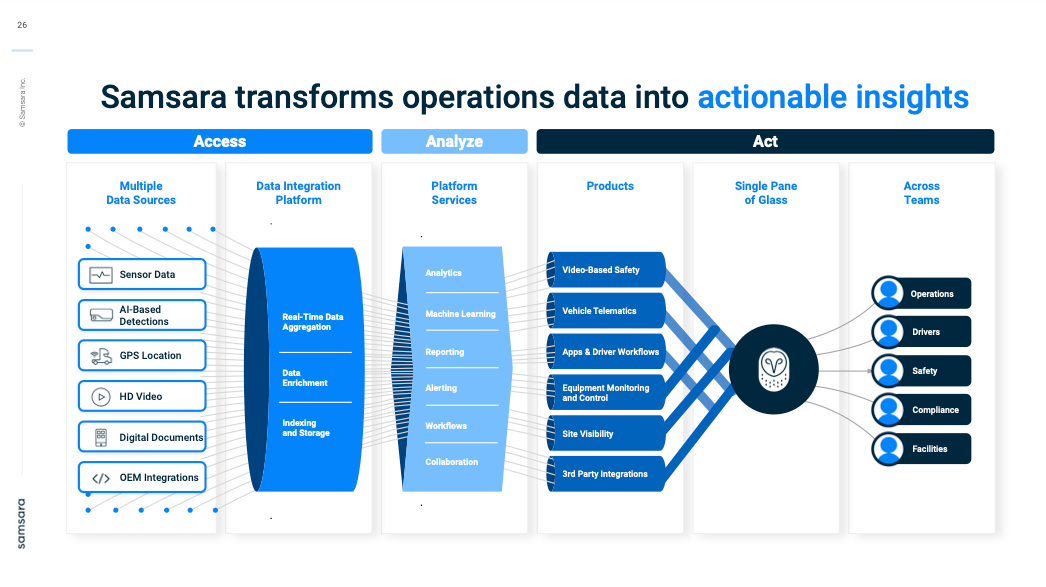

Samsara helps its customers track and analyze data from its internal physical operations by data collection from turnkey IoT hardware it sells, including vehicle telematics (real-time metrics from sensors and the vehicle itself) and computer vision (AI-based cameras). So in this respect, their platform stack has a localized edge component for gathering vital data, pre-analyzing it (via on-device AI), and using a cellular connection to transmit it to the cloud platform. Once the data is ingested into the platform, that data is enriched with other data sources (such as maps, routing, and weather info), and is then run through cloud-based AI/ML layers that perform analytics and predictions, such as the best route to take or predicting maintenance issues or safety events.

That all makes for a very heavy IoT component to this platform's stack, but Samsara has thrived by providing this as a turnkey solution that makes every tracked asset into a giant roving data collector. However, major vehicle and heavy equipment manufacturers are now building these sensors and data processes directly into vehicles and heavy equipment now, which then feed into their own native platform stacks. Yet Samsara does not need to worry about this end-run around their IoT stack, as they are also providing a growing number of cloud-to-cloud integrations with these OEM vendors for this data. Why aren't customers solely using these OEM solutions instead of Samsara? Because customers typically have a heterogeneous (mixed) pool of assets built up of various types, makes/models, and ages of vehicles and supporting equipment across multiple manufacturers. There is little uniformity in physical fleets, even when dealing with a preferred vendor!

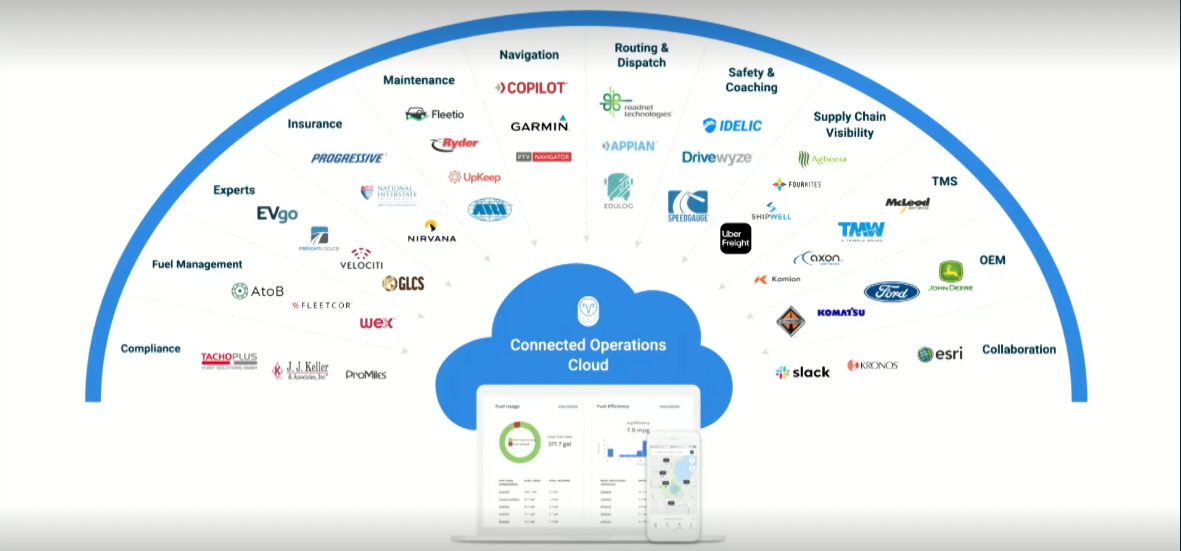

Samsara's critical path is in wanting to be the centralized single source of truth for a company's operations. It not only integrates with OEM stacks, but also has a growing number of integrations with other services and needs around physical operations. It provides an open API for customers to be able to leverage data from other 3rd party tools inside Samsara (fleet mgmt, routing, tire mgmt, fuel mgmt) or to leverage Samsara data in outside 3rd party tools (HR, payroll, ERP) – or even for customers to develop their own custom applications or workflows. By giving users a complete platform that serves multiple needs around tracking and managing physical operations, Samsara is moving towards being a consolidated solution over all these needs – yet can tie into other tools in the ecosystem that have features it doesn't provide.

Samsara is leveraging IoT and AI to allow customers to have smart fleets, smart equipment, smart cargo, and smart locations over factories, distribution centers, and remote worksites – and provide smart operations management over it all. Quite simply, this is a play on the digital transformation of physical operations. Samara repeatedly points out how this remains an area that has traditionally been underserved by modern cloud-based solutions. There are, of course, a number of legacy point solutions for fleet mgmt, GPS tracking, and other needs, but no centralized turnkey solution that addresses them all. This domain is so underserved by technology that a lot of processes (like inspections, delivery receipts, and issue reports) remain pen-and-paper. In a way, this company reminds me of Bill.com, but for physical operations instead of back-office cash flows. [This comparison to Bill fades quickly given Samsara's rate of innovation versus Bill's need to bolt on via acquisition.] It is also similar to Axon's mix of IoT-driven hardware (taser and body cams) pushing data into a centralized cloud platform.

Some quick background

The founding CEO and CTO have done this before. Together they founded Meraki in 2006 to create modular wifi networking equipment that could be managed by a centralized cloud platform – which was eventually acquired by Cisco in late 2012. After a short time at Cisco, they left to start a new venture called Samsara, named after the Sanskrit word for the interconnected cycle of life. They really mixed it up in this new venture – instead of modular wifi components managed by a centralized cloud platform, they decided to create a new solution around modular cellular IoT components managed by a centralized cloud platform. They took their longtime head of hardware from Meraki with them.

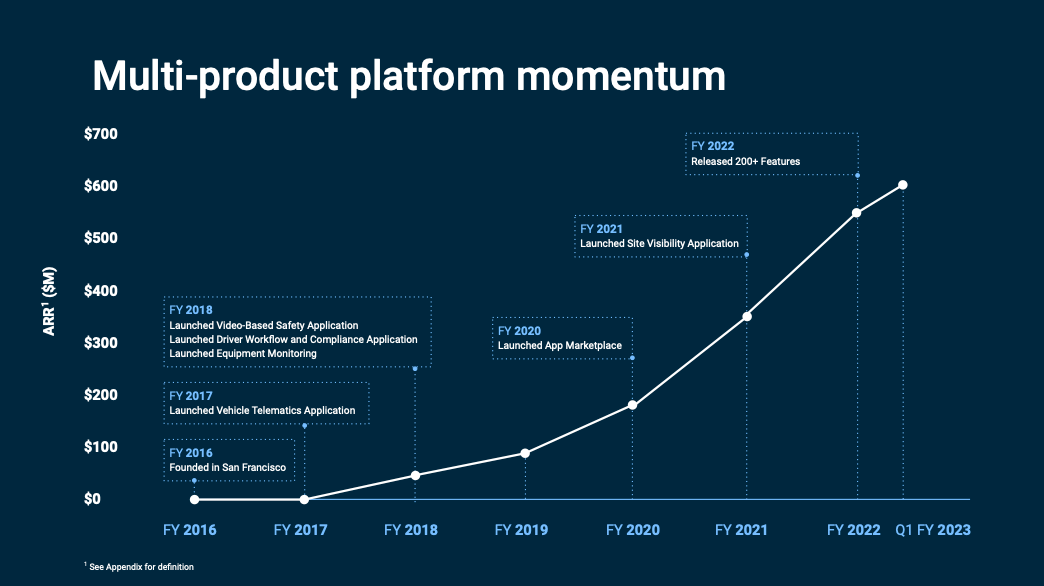

Samsara was founded in 2015 and came out of stealth in 2016 with a vehicle telematics product. The platform then evolved over the next 6 years into 5 separate products built upon the same core architecture stack. They went public in December 2021 – right as the IPO market shriveled up (where it remains to this day).

Connected Operations Cloud

Samsara initially considered itself a leader in Industrial IoT and fleet mgmt, but that focus has shifted over time. By the start of 2021, they rebranded their overall platform into the Connected Operations Cloud, a centralized cloud platform that is driven by data collected from IoT devices. Their stack evolved from a primary focus on turnkey IoT hardware into one that circled around the power of a centralized pool of operational data. Their platform can give customers a complete view of their physical operations, and from there provides a huge number of capabilities across it all that can provide easily proven ROI to customers in a number of ways. Over time they added in more data integrations and ingest features, and introduced both core and edge AI-driven capabilities. Fast forward to today, and they now have 5 core products.

Throughout it all, Samsara has been heavily focused on having its innovations driven by a customer feedback loop, as they spin out new capabilities and product lines out of this centralized operational platform. This has the effect of giving their customers more and more value for their subscription, as well as providing ways to cross-sell into additional priced products. From the customer side, this helps bolster their trust in Samsara as a trusted partner that is working on fulfilling their needs.

Products

They started with vehicle telematics in 2016, moved into video safety the next year, and then driver workflow and compliance needs soon after. These 3 products ultimately made them into a fully featured fleet mgmt solution, yet also veered one layer outward into field equipment & industrial monitoring. This was US- and Canada-centric, which expanded into Europe in 2018 and then into Mexico in 2019. They added a focus on integration partners with a new App Marketplace in 2019. In early 2021, they veered another layer outward into site visibility. Soon after, this core set of 5 products was rebranded as the "Connected Operations Cloud".

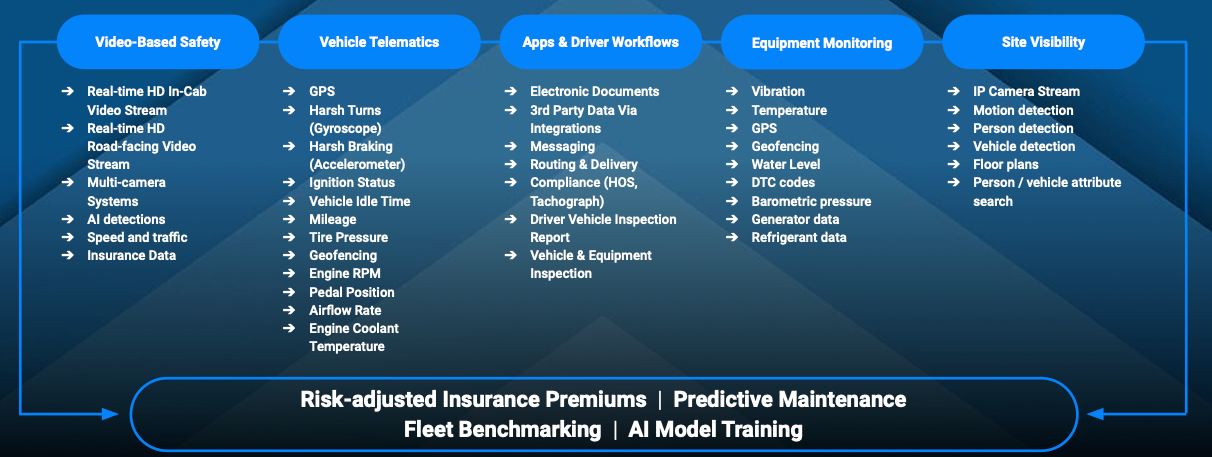

The Connected Operations Cloud now consists of 5 core applications (products):

- Vehicle Telematics provides an IoT-driven data collection system that gives visibility into that vehicle's real-time status and performance. It continually collects GPS location, speed, engine diagnostics, and sensor data, and transmits it all to the centralized platform via cellular connectivity provided by Samsara. Cloud services then enrich and analyze that data, and give a real-time view of a vehicle's status and its route. Cloud-based AI/ML services are used across all these ingested metrics and enriched data (GPS routes, traffic, weather). This product ultimately provides fleet management, location tracking, route optimization, idling detection, and predictive maintenance. Integrations include OEM vendors (for vehicle metrics), 3rd-party fleet-focused services (around fuel mgmt, time mgmt, and route optimization), as well as allowing telematics to be used by enterprise systems (like data warehouses, supply chain mgmt ERP, and HR/payroll).

- Video-based Safety uses the exact same IoT and cloud stack, but instead of vehicle telemetry, ties into AI-based dash cams to analyze video feeds from the road (forward camera) and driver (in-cab camera). At a minimum, this provides a continual camera feed should an accident occur, giving the org a way to quickly prove cause and exonerate drivers. But from there, it soon evolved into a more fully featured driver coaching system. The IoT hardware added embedded AI capabilities that allow the onboard system to determine risky driving actions (tailgating, harsh driving, rolling stops) and poor behaviors (inattentive driving, phone use, seatbelt use) in real-time. These AI features tie in closely with Vehicle Telematics for speed and braking data, so customers typically use both services in tandem. The real-time AI detections have been leveraged to add features like in-cab alerts (audible warnings of a detected risk) and in-cab nudges (coaching suggestions to correct poor driver behavior). On the cloud side, they provide mgmt features to track incidents, measure risk, suggest administrative actions, and provide offline and real-time coaching capabilities such as in-cab virtual coaching sessions. This product ultimately provides a safety tracking system over a vehicle fleet and its pool of drivers, and can determine and help correct safety risks in real time. Integrations include insurance providers (that partner with Samsara to provide safety discounts), as well as enterprise systems (such as HR/payroll). Samsara remains privacy-focused on these video feeds (controlling access, and is able to blur the driver's face or license plates), yet hears from customers that these features are very well received by drivers. It seems a culture of safety greatly helps in driver retention and attracting talent. Some customers have even developed their own applications atop the open API to gamify safety in their organization.

- Apps & Driver Workflows are specialized mobile apps that are highly honed to driver needs within this fleet mgmt suite. This started with giving drivers information about assigned delivery/service jobs and suggested routes, as well as auto-track driving time for hours of service (HOS) compliance. They have been adding other electronic documentation features to digitize pen-and-paper heavy processing like vehicle inspection reports (DVIRs), as well as adding workflow automation features that allow managers to create start-of-day, end-of-day, and incident reporting workflows which then all tie into administrative interfaces for oversight. This area was a heavy focus at their most recent Beyond conference in June, and they previewed a coming Connected Forms capability (allowing digitization of other custom pen-and-paper processes) and a new Mobile Experience Mgmt (MEM) capability that allows greater control over what a driver/worker can do on the device, including a Focus mode to help eliminate distractions while driving. Integrations include collaboration tools and other 3rd party driver-focused solutions that can be triggered by workflows.

I find that the first three products above all combine into a fully featured fleet management solution that covers a wide range of use cases over a fleet of road vehicles and the remote workforce that utilizes them (drivers and field workers). From there, they extended their feature set out to the next layer of needs beyond fleet mgmt, to now track and manage the supporting equipment and distributed locations being used by that fleet.

- Equipment Monitoring extends the Vehicle Telemetry product, but turns its focus toward tracking various types of support equipment for physical operations beyond road vehicles. This includes semi-trailers, refrigerated trailers (reefers), generators, compressors, heavy construction & farming equipment, and unpowered assets like dumpsters and storage containers. This provides asset location and utilization tracking, as well as theft monitoring via geofencing, predictive maintenance, cold chain monitoring, and onsite time tracking. Integrations include OEM vendors (for equipment metrics), as well as enterprise systems (such as billing, ERP supply chain mgmt, or data warehouses).

- Site Visibility extends the Video-based Safety product, but turns its focus towards using AI-based cameras for safety features over distributed locations. It again has edge AI capabilities over on-site security cameras to detect hazards, find operational inefficiencies, detect unusual activity, and provide security and theft protection.

You'll notice how these heavily utilize the combined cloud/IoT stack built by Samsara, who has been busy leveraging it across several product lines. However, Apps & Driver Workflows stands out as being solely a software-based product (provided across their cloud platform and mobile apps) that does not touch the IoT hardware. This provides a new angle for Samsara to explore, as they find and solve other pain points for customers around physical operations.

CEO in Q423 Q&A: "So on the workflows front, we are seeing great traction with the digital workflows that we offer these customers... So we do see that as a growth factor for us driving usage engagement using these apps. And the reason I highlight that is it’s not actually tied to necessarily hardware, it’s another area of value. And these companies are basically moving from pen and paper clipboards to digital process. So that’s an exciting area for us to deliver value to the customer. Today, we’re focused on the areas that I talked about earlier, but we are thinking more generally about can these workflows work at the beginning of a shift or an end of a shift? Can they be used for safety? Are there other use cases and applications. So you’ll see us continue to invest there. And at some point, we may break that out. Today, it’s available as part of our existing product family. But if we start to see usage that gets decoupled from the asset-based licensing model that we have that we talked about earlier that 3 to 5 year seed base, SaaS kind of traditional model, we might price it or package it differently, but we have no plans to do that yet."

As I mentioned before, their recent Beyond conference focused heavily on a number of enhancements in this area. It seems that Samsara is now starting to move more heavily towards software-driven features in workflow automation and electronic documents. (Not surprising from all the mgmt they have been able to hire from ServiceNow.) I expect a lot more to come here, as they expand into other software needs over physical operations.

Capabilities

There are an extensive number of capabilities across the core and product lines:

- Safety: AI dash cams, driver coaching mgmt, safety reports

- Telematics: real-time GPS, routing/dispatch, vehicle sensors, OEM telematics

- Equip Monitoring: trailer tracking, equip tracking, sensor monitoring

- Site Visibility: remote visibility, motion/human detection, operational monitoring, incident investigation, automated alerts

- Compliance: ELD compliance, HOS/IFTA reporting, simple & intuitive driver app

- Asset Life: fault monitoring, engine diagnostics, preventative maintenance, DVIR (driver inspection) tracking

- Workflows: driver workflow, custom job workflows, digital records

- Reporting: pre-built & custom reports, benchmarking

- Data & Integrations: app marketplace, open API, custom development

- Sustainability: fuel mgmt, engine idling detection, EV tracking, EV suitability of fleet

- Efficiency: reports, live link sharing, messaging

- Security: AI security cams, geofence alerts, driver panic button

Customers

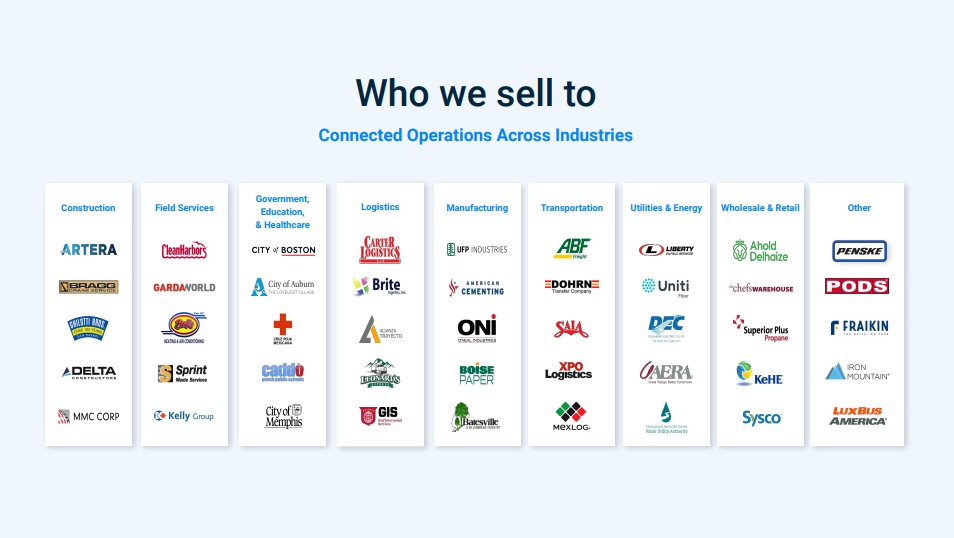

They currently focus on North America (Canada, U.S., Mexico) and Western Europe (London, Germany, France). [They also have an office in Taiwan for hardware dev, plus added a remote development team in Poland.]

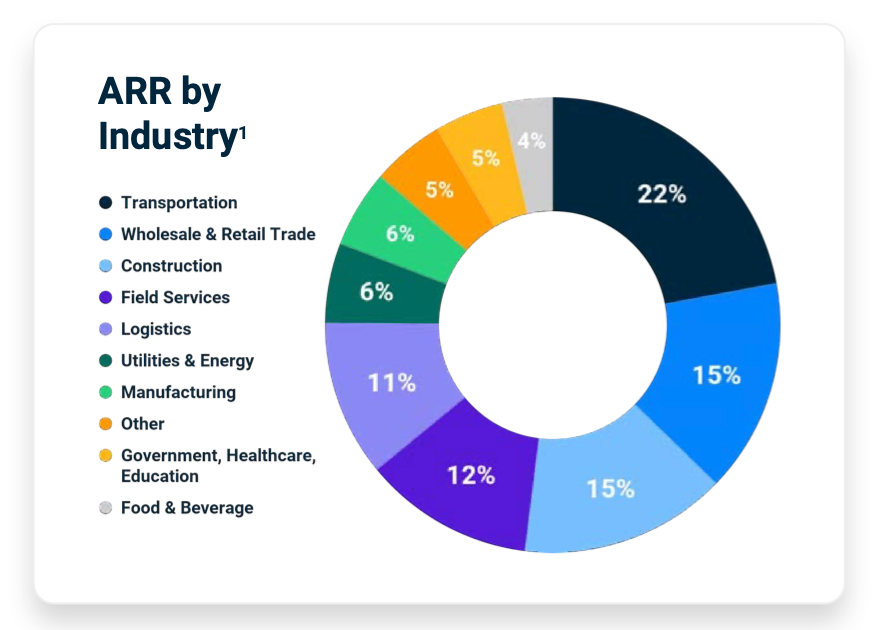

They primarily serve customers across a wide range of industry verticals, including transportation, logistics, field services, wholesale/retail, construction, energy/utilities, government (state/county/local), education, healthcare, manufacturing, food & beverage distribution, and other physical operation-heavy industries. Customers include chemical manufacturers, freight carriers, municipal waste services, critical infrastructure providers, container rentals, school districts, and much much more.

What is common is that all these industries:

- operate high-value assets (vehicles & equipment)

- coordinate large workforces out in the field (drivers, field services, operations, site/facilities, support staff, field managers, etc)

- manage complex logistics across distributed sites (factories, warehouses, distribution centers, remote worksites, customer locations, pipelines, etc)

- have heavy environmental, safety, and regulatory compliance requirements

Some big customer wins over the past year have included Coach USA in Jun-22 (with 1.5K buses), Werner in Dec-22 (with 8.5K semis, 27K trailers, 14k staff), Nutrien Ag in Mar-23 (with 75k assets), and Estes Express Line in Mar-23 (with 9.6K semis, 37k trailers, 270 sites, 22k staff). Other Fortune 1000 customers mentioned include Univar Solutions, United Rentals, and Iron Mountain. Beyond the big ones, they have done writeups on a number of other enterprise and midsize customers from there. See all their customer profiles, which also highlight the ROI achievements in each.

Mgmt notes that the buyer of this is typically the COO or VP of Operations, and is from the operational budget – which tends to be less discretionary than IT budgets.

CEO in Q323 Q&A: "So, our customers are concentrated within the operations organization. It could be VP of Operations or COO, and that's typically the budget that it comes out of. This is the same budget, by the way, that also is related to their accident and insurance payouts, their operating efficiencies, and the capital equipment they're buying. So, for us, there's a direct correlation between adopting our platform and being able to save money and gain ROI in those areas. So, it's that same buyer, it's that same budget center.

They price their platform on a subscription fee per asset covered per product. So for a vehicle in both telematics and video safety, it requires 2 subscriptions. Mgmt notes that contracts are typically for a 3-5 year term, and are non-cancelable. This fee covers cloud-based apps, mobile apps, cellular connection, integrations, and support. IoT hardware is covered by separate fees built into the subscription price, so is ratable over the contract term. Pricing is obscured, but this review notes that Vehicle Telematics has a base rate of $27-33 per vehicle per month with a 3 year minimum – which means $324-396 per year.

ROI

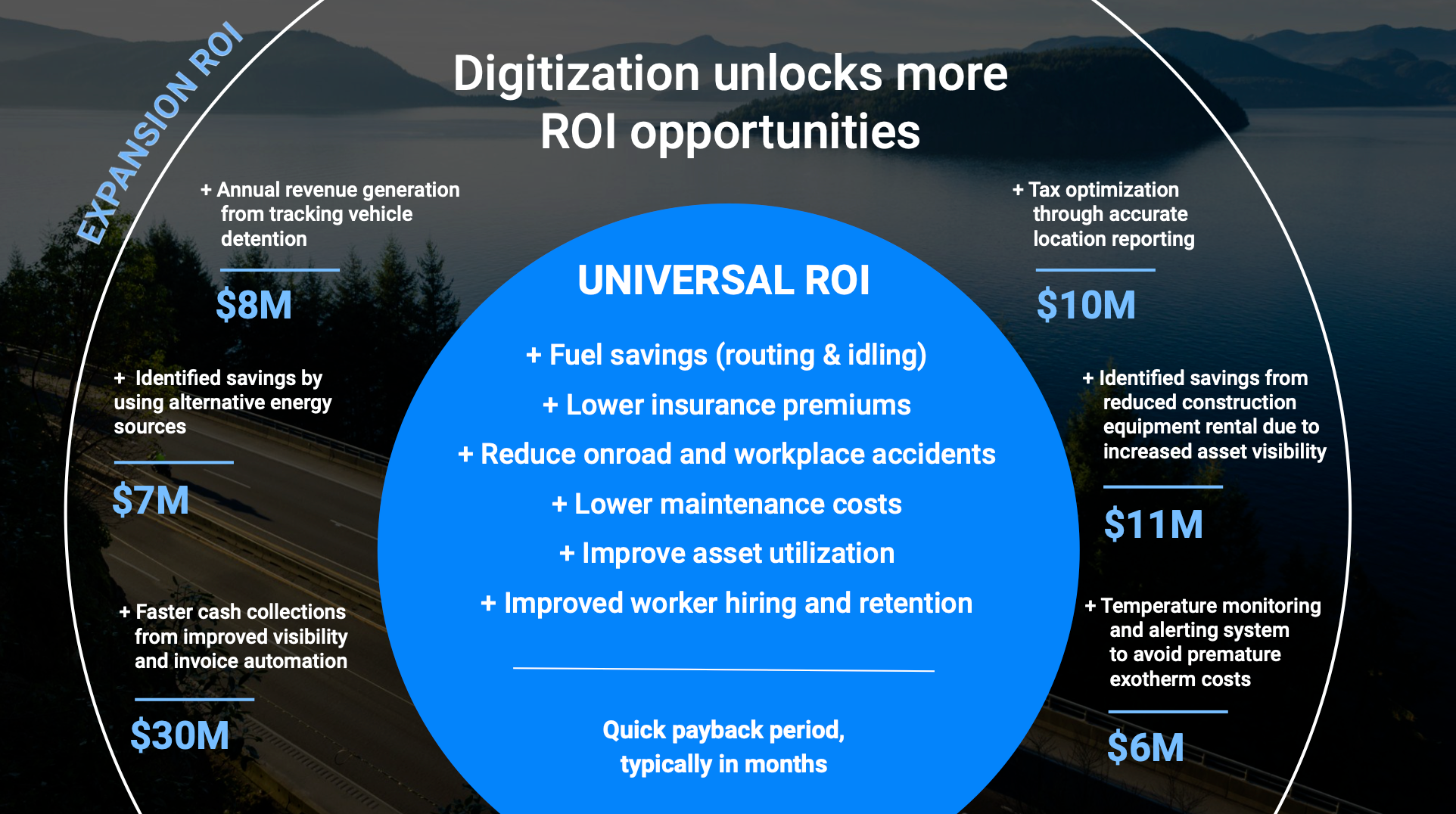

The majority of assets in physical operations remain offline. Beyond that, data has been siloed, leaving it difficult to analyze. Beyond the basic needs of having visibility and analytic capabilities over physical operations, Samsara's marketing heavily focuses on 3 areas: safety, efficiency, and sustainability.

There are a number of overlapping ROIs achievable within those.

- Safety (reduce business risk): critical visibility of assets across distributed locations, fewer safety incidents & accidents, exonerate drivers, insurance savings, compliance & policy adherence, better driving habits, improved safety culture, better driver retention, theft prevention

- Efficiency (reduce operational costs): improve asset utilization, prolong asset lifespan, manage remote staff and assets at scale, reduce staff needs, lessen time spent on manual tasks, reduce fuel use from proactive steps (less idling, better driving habits), digitize manual processes at scale, reduce energy use in equipment, discover time waste in operational processes

- Sustainability (reduce both risk and costs): improve energy/fuel efficiency, lower emissions, automate & assure regulatory compliance, lower carbon impact, improve the lifespan of assets, improve asset & employee productivity and safety over it all

They released a cost savings survey in Aug-22 that highlights ways customers are saving money. They sampled a subset of new logistics and field service customers, and found that in the first year of use:

- There was a 47% reduction in crashes (each costing $16.5-74K on avg).

- There was a 40% decrease in idling (saving ~$2500/yr per vehicle, at $5/gal).

- There was a 20%+ improvement in vehicle utilization (recouping an avg 10% waste per year).

Samsara's services pay for themselves quickly, with payback typically in months from the huge savings a customer can get in operational costs. Other mentioned ROI unlocks include tax optimization from precise location reporting, measurable improvements in operational efficiency, end-to-end monitoring of refrigerated items to prevent waste, and improved customer experiences with real-time notifications of delivery arrival times.

CEO in Q423 Q&A: "So from an ROI perspective, it’s absolutely a strong case. We have multiple opportunities to provide value to our customers on the safety side when it comes to helping exonerate drivers from accidents or even reduced risk to avoid accidents in the first place. That’s really compelling. And for these large scale complex physical operations customers, it can save them millions of dollars on a yearly basis. Similarly, for fuel, it’s the same story, coaching drivers to operate a little more fuel efficiently and then optimizing the assets and the workloads and the routes to be fuel efficient can save these customers millions of dollars a year. So that ROI case is really strong. And that pipeline conversion remains strong, in spite of what Dominic mentioned, where there is a bit of elongation on the sales cycle. So I think we feel good that we have got a compelling value proposition. The win rates continue to be stable. And it’s a very, very large market. We are talking about tens of millions of commercial vehicles here in the U.S. even more in Western Europe. So I think just in terms of our core market and our core value proposition, the ROI is there and customers are very much tuned for this as they think of ways to save money in this environment."

Stack Layers

There are a number of layers within their platform stack.

- They provide a cloud-based platform for operational managers.

- They provide mobile apps for drivers and field svc workers to interface with the platform remotely.

- They provide IoT gateways to connect to and collect data from vehicles, equipment, and sites. From those gateways, customers can tie in other IoT accessories like AI cameras and a number of turnkey sensors.

- They provide an open API for customers and partners to pass data into or out of their platform, which in turn ecosystem of cloud integrations (now 240+ of them) within an App Marketplace.

- Underlying the cloud platform is all the cloud computing for AI/ML processes over data and video processing.

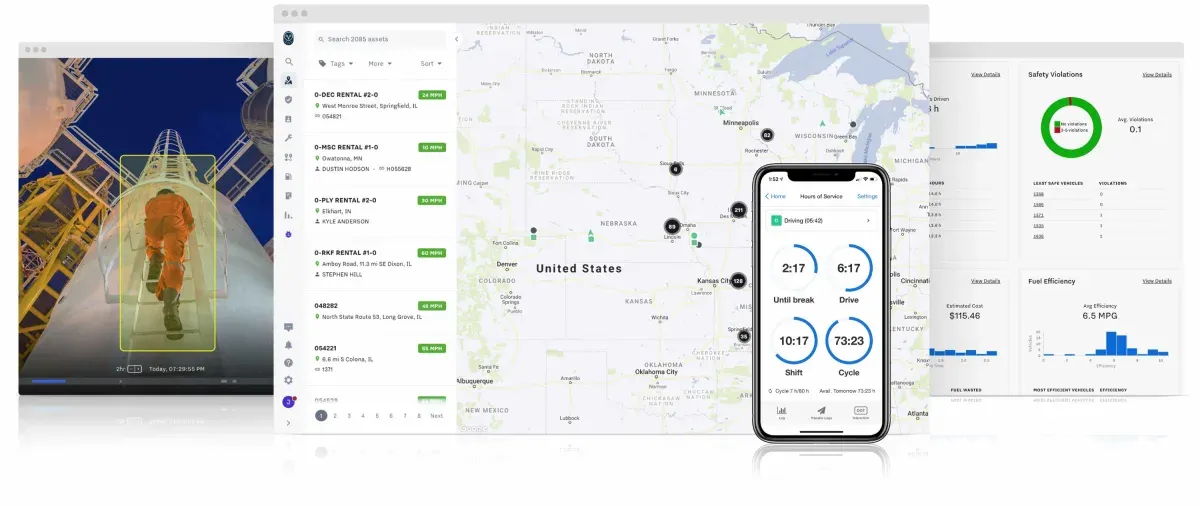

Core Cloud

The primary interface for visibility over physical operations is the Samsara web app, primarily used by operational managers. This contains map-based interfaces for location and routing features, as well as dashboards and analytics for managing physical operations and surfacing issues at scale.

- Connectedness: Can ingest data from their IoT hardware or from their open API, plus they also partner with OEMs to capture metrics via APIs. They also allow integrations with enterprise software and pulling data into enterprise apps and BI systems.

- Data Platform: The platform ingests, aggregates, and enriches data from IoT and ecosystem integrations. From there it applies AI/ML & analytics and has features to automate workflows, surface & track issues, trigger alerts, and provide data security & privacy.

- Actionable: Operational data is made actionable thru their products with real-time alerts, asset utilization analysis, safety scoring, driver coaching, recommendations, and predictive maintenance.

Mobile Apps

Fleets are rolling out mobile devices to drivers and field workers to be able to use supporting applications. Samsara provides mobile apps for modern iOS and Android operating systems, and recommends using them on tablets like Apple iPad and Samsung Galaxy Tab models. Their native app is well-rated in both Apple Store (4.7 stars from 5K+ ratings) and Google Play (4.5 stars from 8.6K+ ratings, having 500K downloads).

IoT

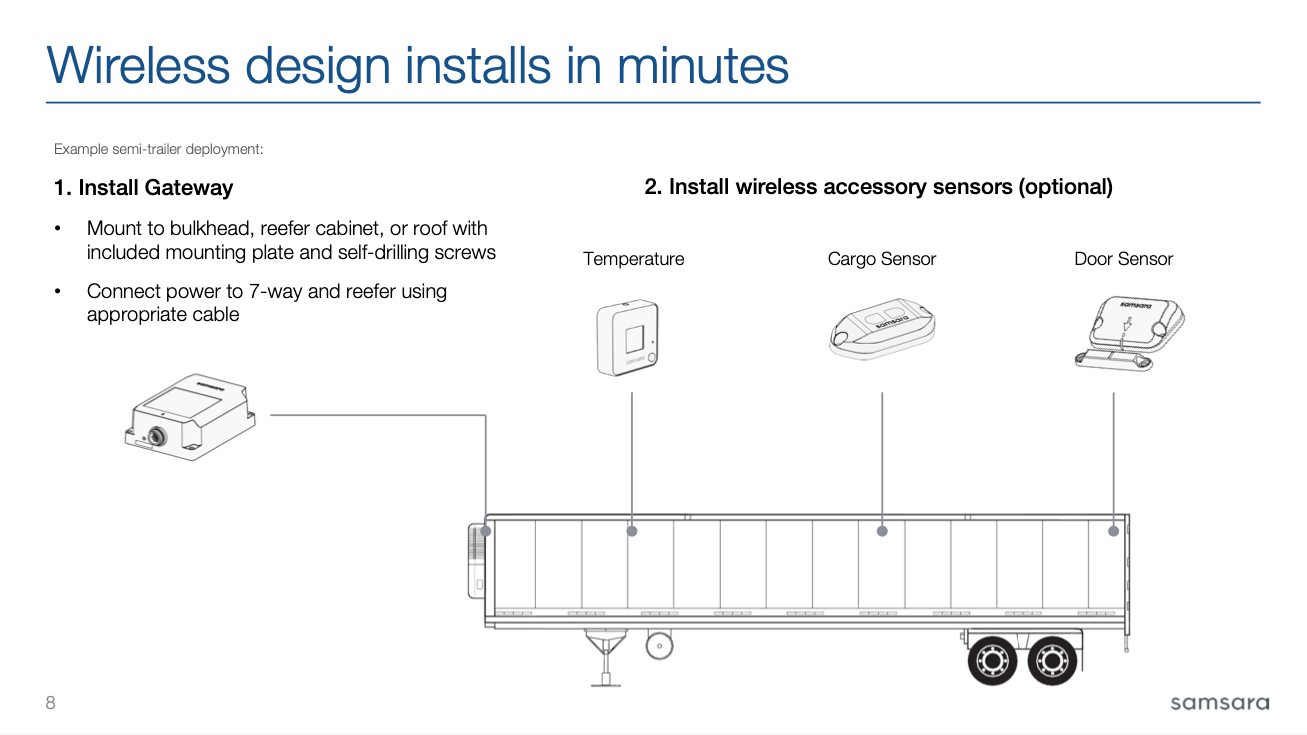

Their focus here was to provide turnkey IoT hardware that the customer can easily self-install, though they also have implementation partners that can help customers. The key to their IoT stack are their Gateway products, which provide GPS and cellular 4G/LTE connectivity to a vehicle, equipment, or site in order to collect and send data to the cloud. From there, they provide a number of AI-driven cameras and accessory sensors that then hook up to the given Gateway.

From the S-1: "We expect that the need for our IoT devices will diminish over time as physical asset OEMs begin to produce connected assets that can connect to our Connected Operations Cloud without additional IoT devices provided by us."

Despite this reliance on hardware in their stack, they maintain impressive margins. Their strategy is to focus on the Gateway as the central point, then leverage it as much as possible. They've been adding inline AI features to the Gateways and Cameras to enable features that blend real-time inputs from the camera and sensor to recognize unsafe driving practices.

- Vehicle Gateways provide GPS tracking and cellular connectivity to vehicles like work trucks and semis. This allows it to collect and transmit data from vehicle-provided metrics (such as engine, battery, fuel, and brake systems) and other accessory sensors (driver badges, panic buttons, etc).

- Asset Gateways provide GPS tracking and cellular connectivity to equipment, including semi-trailers, containers, or heavy equipment for construction or farming. It comes in unpowered (battery-powered) or powered models, as well as a higher-end powered+ model that can integrate with accessory sensors like temperature, cargo, and door monitors. They used to have a separate line of Industrial Gateways for tying directly into industrial systems (ICS), but those have been folded into Asset (Equipment) Gateways.

- Site Gateways provide camera DVR and cellular connectivity to distributed work environments, including factories, distribution centers, loading docks, and remote work sites.

- AI-based cameras tie into Vehicle or Site Gateways to provide visibility and computer vision features (detection) over vehicles and sites. Customers can also tie in existing camera systems through an optional camera connector.

- Other sensors are available that interconnect to the Asset Gateway to empower smart trailers & smart reefers (refrigerated trailers).

Leaving Industrial IoT behind

One thing to note is how they also had been moving heavily into Industrial Equipment Monitoring as a separate part of their Equipment Monitoring product. They created more specialized IoT hardware called Industrial Gateway that could interface directly to Industrial Control Systems (ICS) like SCADA or PLC controllers. This was moving heavily into providing real-time monitoring of manufacturing and energy systems within the Connected Operations Cloud.

They had most recently updated their Industrial Gateway lines with an IG15 in Jun-20 and a more advanced IG41 in Jan-21 with additional serial, USB, and network connectors to directly connect to specialized equipment. However, they sent a notice in early Dec-21 that they were stopping the sale of all Industry Gateway products (anything moving into ICS) that month, and that the entire segment was being end-of-lifed at the end of 2025.

[See their complete end-of-life schedule for hardware products. You can still find their Industrial Solutions page on their website via web search, but it is not linked through their current menus – and I'll note that "Manufacturing" isn't highlighted in their Solutions by Industry menu either.]

It seems they are abandoning these Industrial IoT moves to monitor and control SCADA/PLC systems. This is an area that likely needed heavy customization over all the various kinds of specialized equipment built over the decades (each having custom connection types and monitor/control commands) – meaning that it likely required heavy R&D efforts, plus meant the customer then required a heavy amount of help in implementation. For now, they seem to be fulfilling contracts but not selling new or replacement systems any longer. They are trying to help customers deal with this move by allowing them to terminate contracts early. All Industrial IoT hardware will be shut off and deactivated ~2yrs from now (end of 2025). They appear to be trying to push these customers into their simpler Asset Gateway line (GPS location tracking, simple sensors like temp) but does not have the ability to integrate with specialized equipment. [IG refers to Industrial Gateway, AG to Asset Gateway in the quote.]

From the notice: "As of December 1, 2021, Samsara has made the decision to end-of-sale the IG41 and IG15s. We will continue to support all current IG functionality for customers with active licenses until our End of Support date, December 31, 2025.

... Our End of Support date for all Industrial products and IG-dependent products is December 31, 2025. The End of Support includes all “Industrial EOL” products ...We will also end support the Industrial Cloud Dashboard on December 31, 2025. Key features that we will no longer support as of the End of Support date, including PLC automation functionality. ... We currently do not offer a replacement option. Our AGs serve the majority of our IG-customer use cases.

... Samsara still has a strong focus on equipment tracking and monitoring through our AG-series products as this use case aligns most closely with our core business. We hope to continue our partnership around any opportunities we are able to service through these products and their corresponding feature set.:

This was occurring right as they went public, and I haven't seen any mention of this shift by mgmt. They seem content to push Asset Gateway for these types of needs, and I imagine that customers or partners could use the open API to push this kind of specialized (highly customized) data into the cloud platform instead of Samsara having to build it.

Integrations

They have a wide range of partner integrations for both leveraging additional data sources inside Samara, as well as using collected data in outside 3rd-party solutions. Clearly this drives adoption, and their largest customers (>$500K) grew from 4 integrations on average in FY22 to now 6 in FY23.

- OEMs of vehicles and equipment providers: This allows customers to tie into an OEM's native data collection system for vehicle metrics, including Ford, Volvo, John Deere, and International. At their Beyond conference last year, they announced new partnerships with GM (Chevy) and Stellantis (Ram/Dodge) work trucks, as well as ThermoKing smart reefers.

- Vertical software solutions: This allows customers to directly integrate with other SaaS services for specialized fleet-related needs, including tire mgmt, fuel mgmt, compliance reporting, vehicle maintenance, delivery/freight tracking, navigation, and routing & dispatch services.

- Enterprise Apps: This allows customers to pull physical operations data into business operational tools around HR, payroll, ERP, supply chain mgmt, and collaboration tools.

- Data Warehouses: Beyond enterprise apps, customers can push operational data directly into a modern data warehouse or lake. This is getting more attention lately – at the latest Beyond conference, they announced new integrations with Fivetran and Kafka.

- Insurance providers: Samsara allows partners to integrate with customer safety data, which in turn can provide discounts for lower-risk profiles. This is proving to be a funnel for new fleet-heavy customers looking for a meaningful reduction in insurance premiums.

- Custom Apps: Customers can also leverage the API themselves directly in their own custom apps and workflows. As noted before, some customers have gamified driver safety and training.

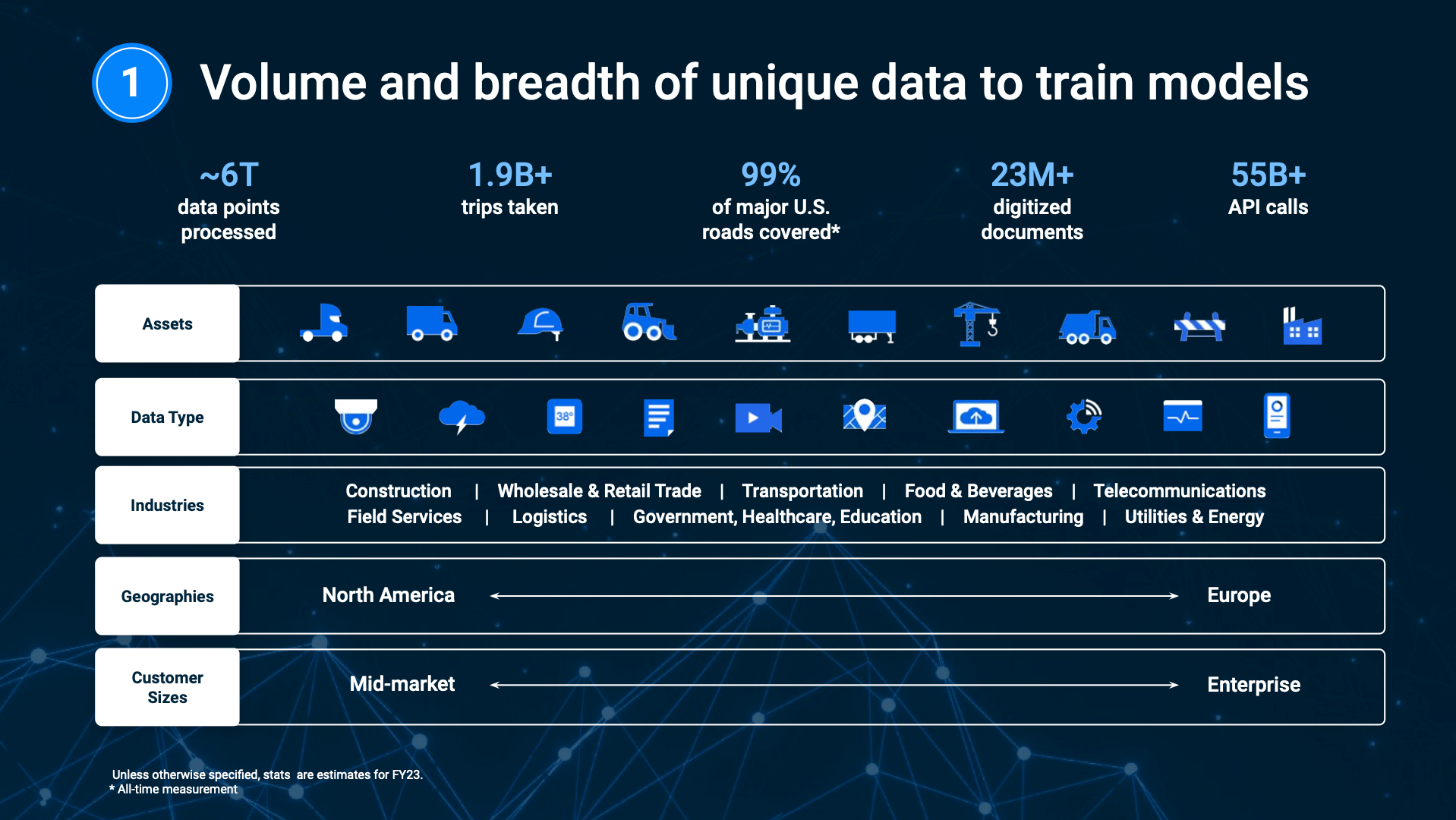

Data & AI

Samsara is pushing how their platform provides a single source of truth over a customer's physical operations. Over the past few years, this means a huge amount of data has been collected (volume) across a wide number of assets and industries (breadth). This is a data-driven platform that already benefits from AI/ML (heavily utilized within their cloud platform and at the IoT edge), and is clearly well-positioned to take advantage of the recent advancements in Generative AI and LLMs.

They have been leveraging AI/ML for years, including AI features in computer vision in Video-based Safety and Site Visibility, as well as ML-driven analytics over metrics fed in through Vehicle Telemetrics and Equip Monitoring. They continue to explore AI features, and mgmt recently hinted at IR day 2023 that they were exploring other directions from here, such as an LLM-driven "Copilots".

That's all on the platform and architecture. A follow-up post looked at their recent execution and the announcements out of their Beyond conference in June, as well as growth vectors and cautions from here. Join Premium to read more!

-muji