Figma released an S-1 in July, and IPO'd a few weeks later. Figma is an enterprise SaaS platform that dominated the competition over the last few years – and is in hypergrowth today with several new product moves and growth levers for tomorrow.

Let's walk through Figma and what I like about its stance and opportunities from here. Part 1 looks at their rise and dominance, while parts 2 and 3 [paid] will go over their product suite, GTM mechanics, and growth vectors from here.

Join Premium for insights like this every week across AI & ML, Data & Analytics, Next-Gen Security, DevOps, SaaS platforms, and the hyperscalers. I've recently did a deep dive into Netskope (who just IPO'd last week), covered recent earnings from Rubrik, NVIDIA, Samsara, Axon, and Cloudflare, and looked at announcements out of Samsara Beyond, Cloudflare's growth vectors from here, and rising AI buildouts from the Hyperscaler Clouds (AWS, Azure, GCP, OCI, and Meta).

- It took 3-4 years to create the initial GA release of their product in 2016. However, Figma had a lot of advantages as a latecomer to the web app design tool market. Most importantly, their cloud-based architecture gave it inherent collaboration features that siloed desktop tools could not compete with.

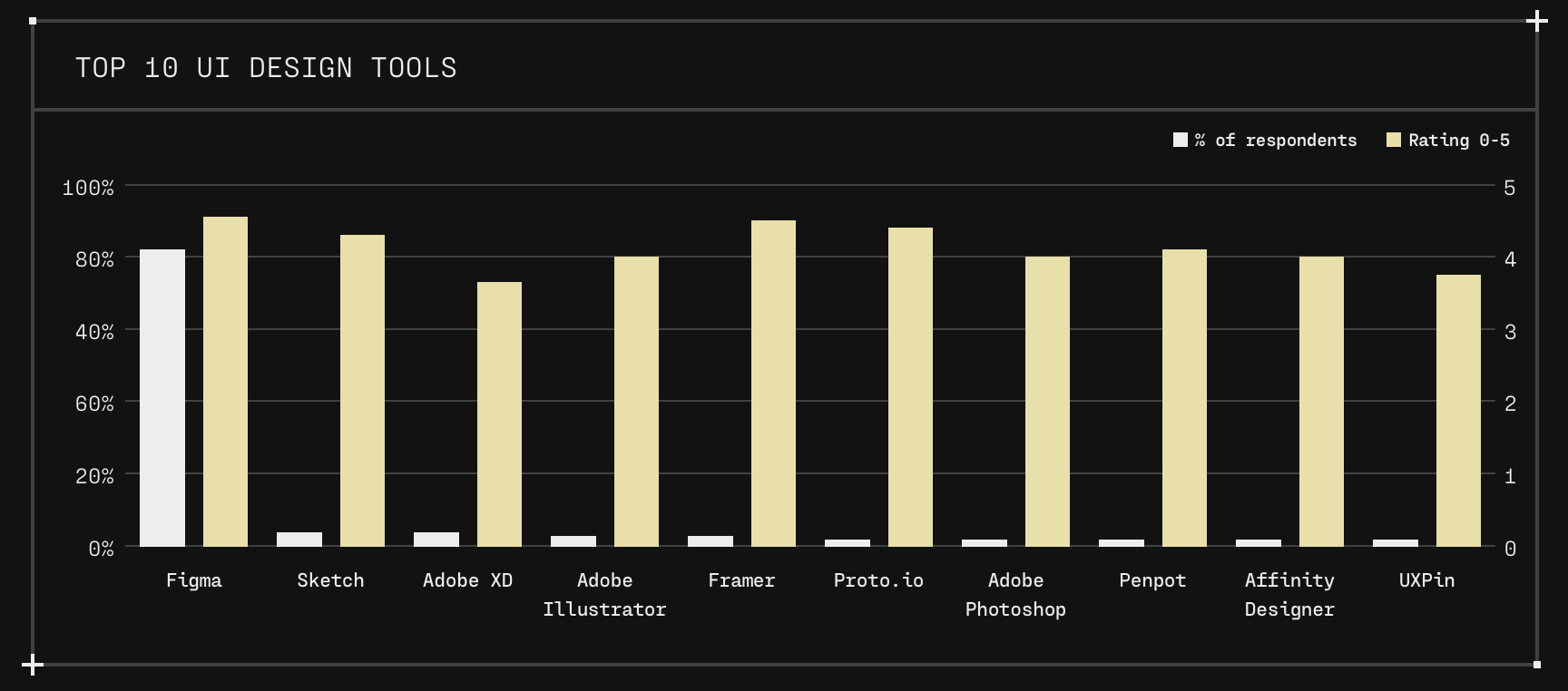

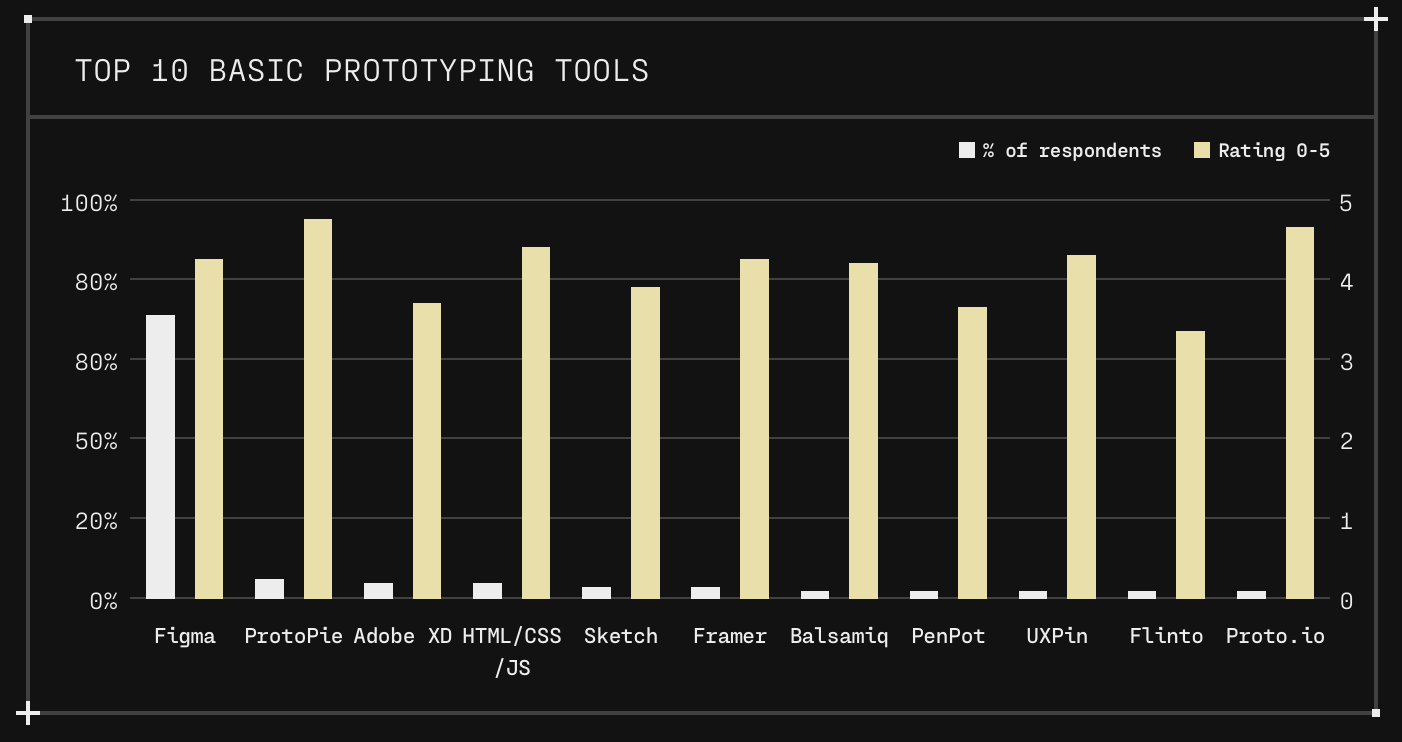

- Figma proceeded to crush the competition in UI/UX design and prototyping, and maintains an over 80% market share in its core UI/UX design features, and over 70% in prototyping.

- Figma has also excelled at expanding the audience of its platform to include new personas beyond design teams, moving heavily into the project managers, developers, decision-makers, and marketing teams that rely on their output (aka the non-designers).

- Competitor Adobe attempted to acquire them in 2022, but after 15 months in a regulatory stalemate, Adobe and Figma walked away from the deal. This had a big impact on Figma's financials in several ways.

- Figma has experienced strong growth over the last few years and remains in hypergrowth mode, with impressive land-and-expand metrics as it moves upmarket.

- Figma is evolving from a standalone tool into a connected platform, featuring a comprehensive suite of design tools. It is pivoting into new products, market adjacencies, and AI features, including competing more directly against Adobe and other point solution competitors.

The exciting financials

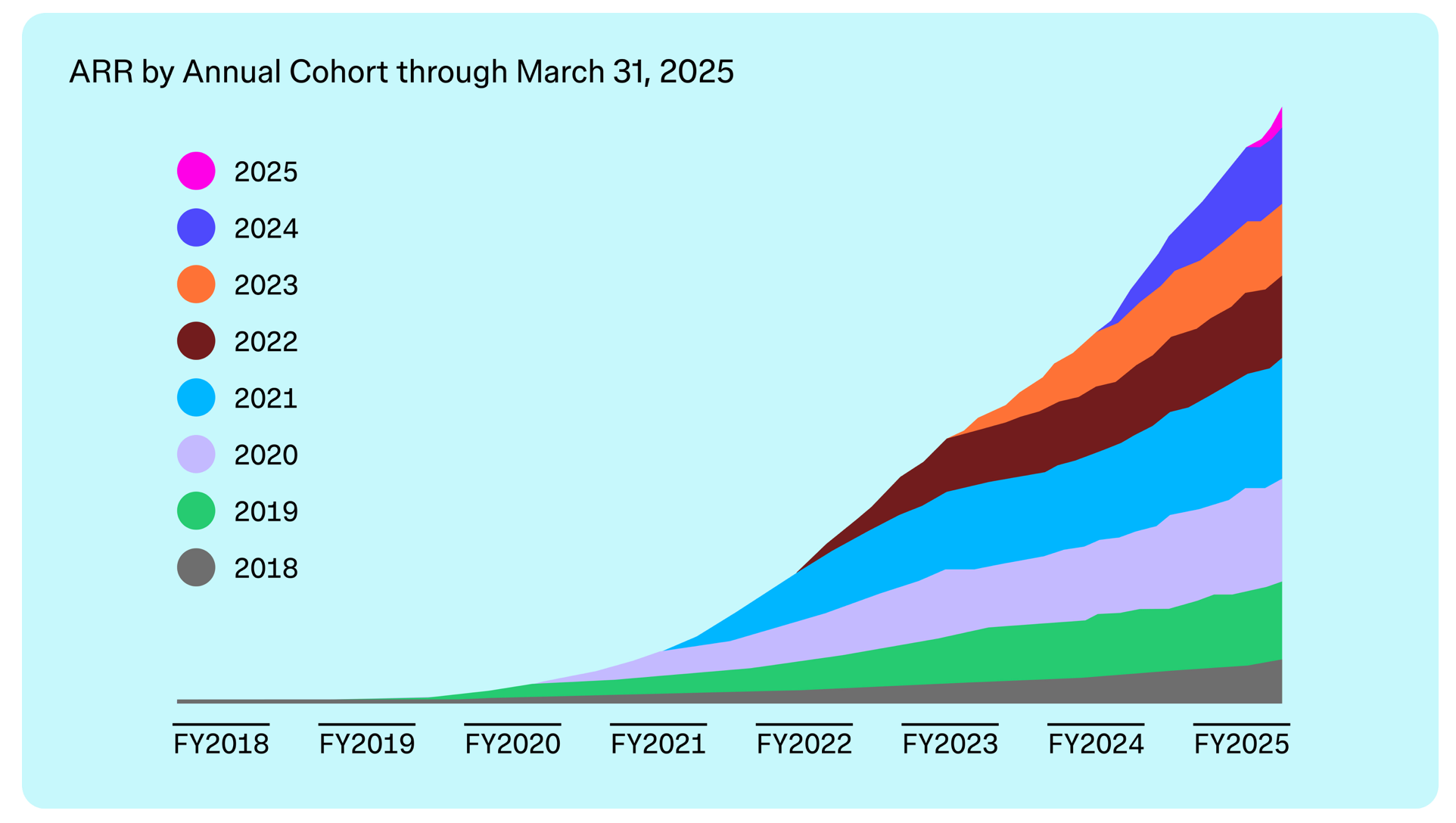

First, let's set the tone and get right to the attractive financials showing hypergrowth. As of Q1 2025 (ending March 31st):

- Revenue was $228.2M, growing +46% YoY. This implies an ARR of $913M.

- Gross margin was 91%.

- Adj op margin was 18%, rising +6pp YoY.

- Adj FCF margin was 41.4%, rising +10pp YoY (after removing the impact of last year's acquisition termination fee).

- They have $1.5B in net cash (thanks, Adobe!) and no debt.

They have a PLG-driven, bottom-up motion, and are priced per seat per month, with customers typically having an annual contract paid upfront. Initially geared for individuals and small teams, they have been moving upmarket heavily since 2022. They are showing some extremely strong land-and-expand metrics.

- They have 13M MAU over free and paid tiers.

- They have over 450K paid customers, with 3/4 using 2+ products.

- Core customers (ARR>$10K) rose +39% to 11107. These provide 27% of ARR.

- Large customers (ARR>$100K) rose +47% to 1031. These provide 37% of ARR.

- NRR rose +7pp to 132%.

App Design Basics

Some quick tech definitions to understand the basic terminology around app design that you'll see in reading up on Figma:

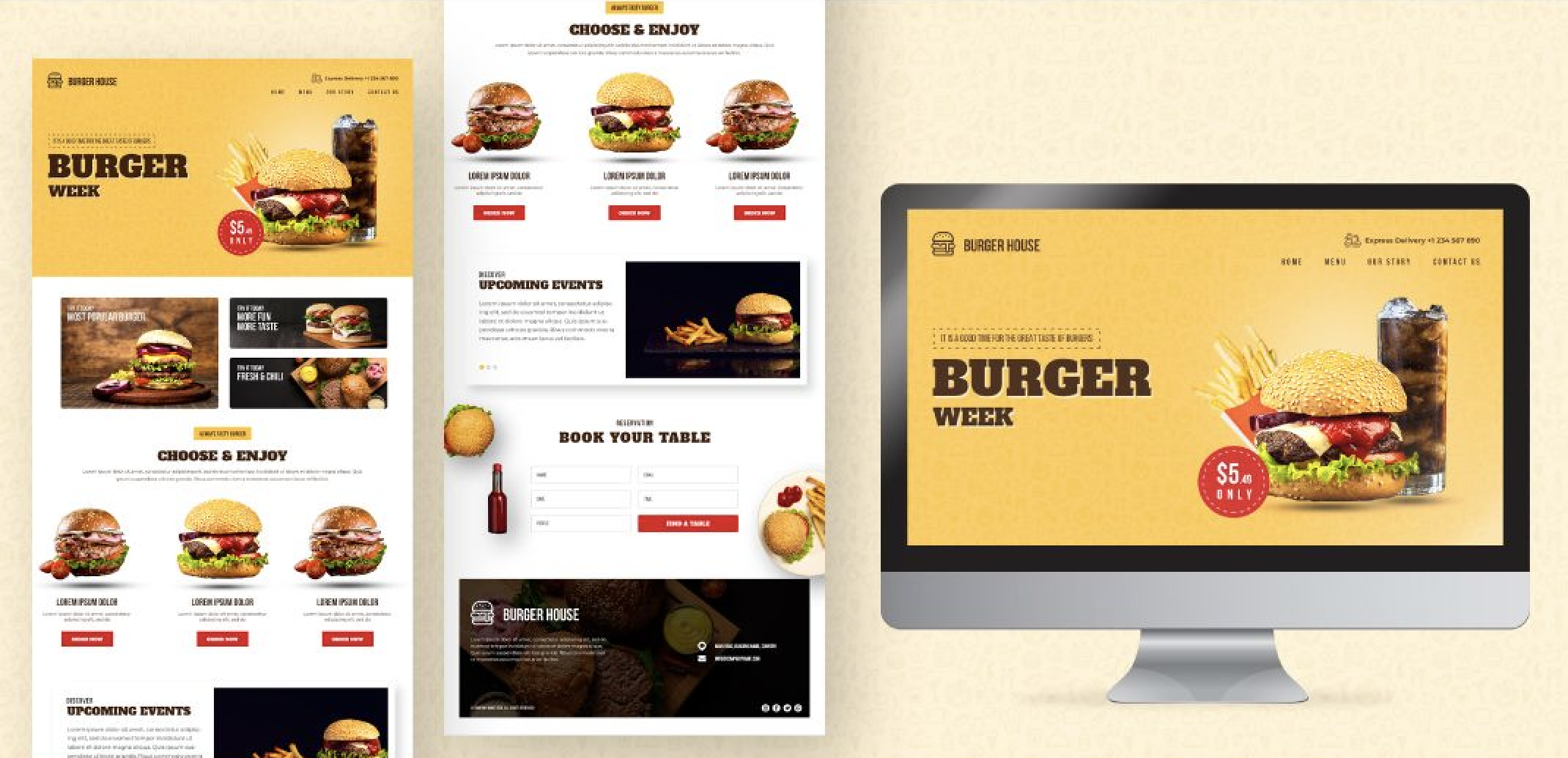

- UI (User Interface): The visual elements within an application or website, including the layout, page sections, visual styles, and components (menus, buttons, fonts, text layout, forms, imagery, visual interactivity) within.

- UX (User Experience): UX focuses on how the customer uses an application, to ensure app workflows and user actions are easily understood and efficient. This focuses on the critical user interactions across the page flows within a web or mobile application as a customer or user interacts with it – such as the product browsing, shopping cart, and checkout workflows within an e-commerce app.

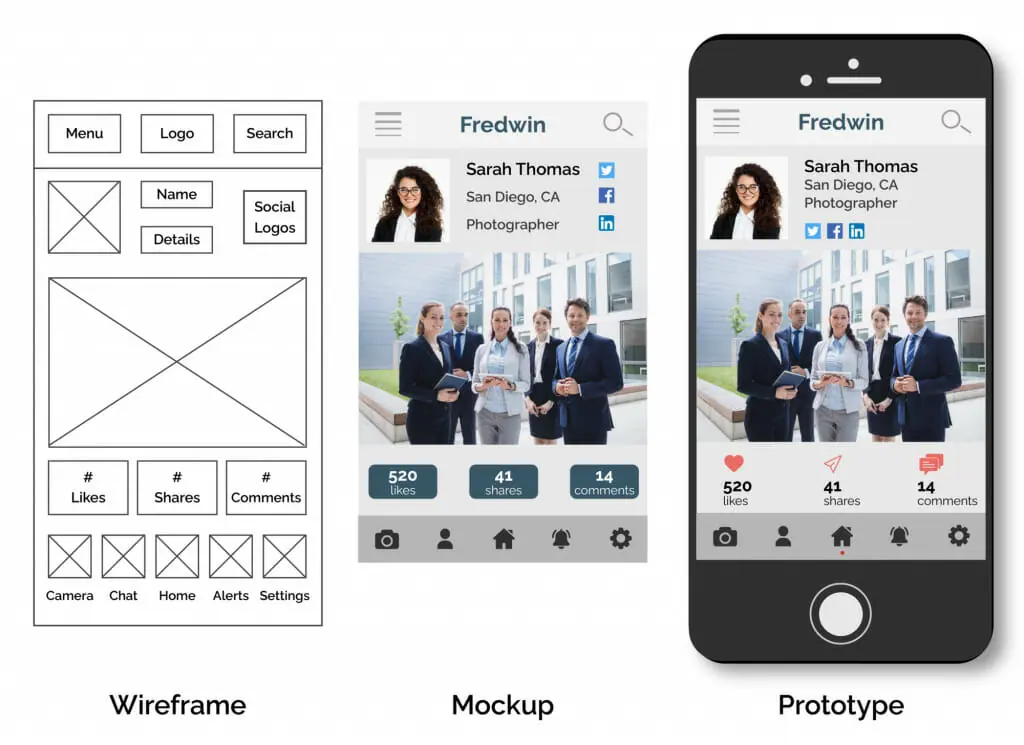

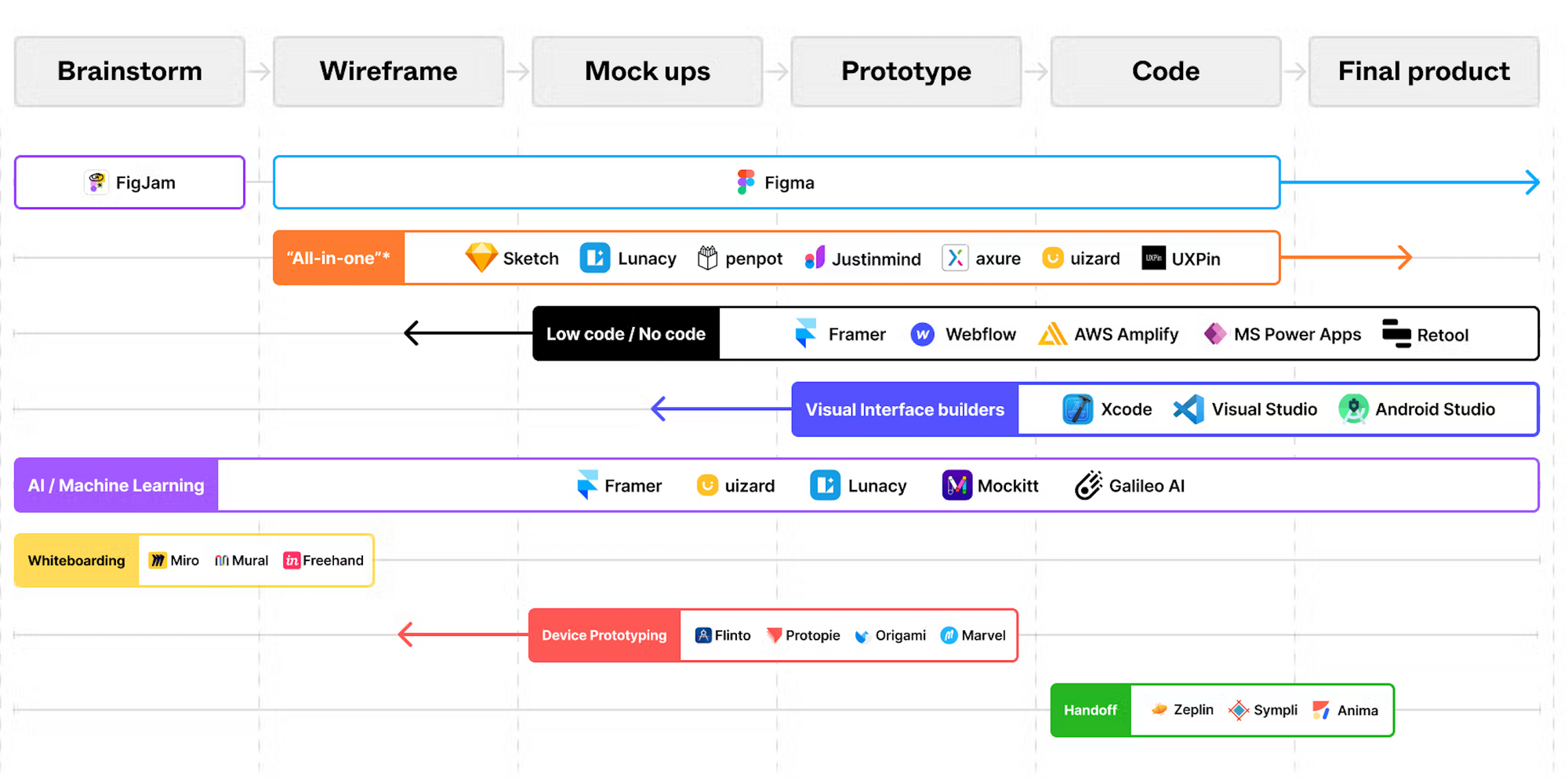

- Wireframes: Simple visual guides to list the various pages/sections of an application, the user workflows across them, and interaction & decision points within. Think of it as a flowchart that serves as a blueprint for an application, including how the pages tie together and a diagram of basic design considerations and layout.

- Mockups: Static (non-working) visual representations of specific application pages with more advanced design considerations (higher fidelity layouts, buttons, fonts, text format, etc). Typically filled with fake data (filler images and "lorum ipsum" text).

- Prototypes: Interactive application pages with more finalized (highest fidelity) design elements, which allow decision makers to walk through pages and user workflows. Ultimately, these serve as the handoff to app developers who then implement the design elements in app code.

- Design System: A collection of design standards and assets (templates, layouts, shared components, imagery, brand assets) across an organization and its product lines. This provides a common language for designers and app developers across the org to unify the look and feel of applications, as well as in marketing efforts (social media, digital ads, emails, brochures, whitepapers).

- Responsive Design: Design frameworks for web apps that allow creating one common set of design assets (layouts and components) that can dynamically adjust to the various screen sizes across any device or browser. Some common open-source libraries for this are Tailwind CSS, Bootstrap, and Google's Material Design. [Adjust the width of your browser window to see how well a given web app handles this.] Figma stresses this design format over alternatives like adaptive design (creating different designs for each screen size, such as separate mobile vs desktop layouts) and mobile-first design (design first for smaller screens, then scale it up for desktops).

Figma

Figma is a SaaS platform that focuses on the design and prototyping of websites, web apps, mobile apps, and other digital products (brand assets, icons, logos, ads, etc). Somewhat similar to DevOps tools for continuous app development (such as GitLab), it is a platform solely focused on the UI/UX – the user interface (app and page layouts) and user experience (flows and user interactions through the app) aspects of product development.

Released in 2016, Figma was a groundbreaking design tool in the right place (in the cloud and in the browser) at the right time (during the rise of web and mobile apps). Unlike past design tools:

- It was delivered as a cloud-native web app – making it browser-based instead of a standalone desktop app.

- Being cloud-based allowed the platform to easily integrate collaboration features, transforming design from a solo activity (isolated designers and tools) into a multi-user one. This enables a design team to work on and track product design workflows across multiple team members in real-time. Like code platforms, Figma tracks all design changes (and who made them) throughout the entire process via version control, allowing teams to see what changed and by who, and allows for branching off experiments and easily rolling back if needed.

- Their cloud architecture also allows for non-designers to now take part in the iterative design process. Product managers, marketing, and app developers can now view, collaborate, and provide ongoing feedback to design teams across the entire process. They can now be providing constant feedback throughout the entire process (ideas, experiments, wireframes, mockups, prototypes, implementation), instead of having design work be done in silos and having to wait for a big reveal until they can contribute.

- Design workflows were complex and multi-step, requiring continual file handoffs between silos (designers, product teams, decision makers, and other participants) throughout. Figma turned this into a trackable process managed by a centralized platform, where all designer and non-designers can contribute, see the ongoing status in real-time, and have a voice (via comments, emoji reactions, audio chats, or polls).

- This platform significantly enhances the speed at which ideas turn into designs turn into products. It fosters ongoing iteration, experimentation, and collaboration of product designs, then allows the final versions to be easily prototyped and approved. Finalized & approved designs are then handed off to the product developers (as code) and marketers (as brand assets and digital imagery) who will implement them.

- Figma does not exist in a vacuum – it integrates with other being used by product teams, including Slack, Monday, Atlassian, and GitHub. Figma has a PLG-driven bottom-up motion that fosters a big community of designers, and has a big ecosystem of plugins (via API) and templates.

- Having a centralized platform around the entire design process encourages mid-sized and large enterprises with multiple product teams or divisions to centralize all design assets in an org-wide design system – allowing the org to create and maintain a set of reusable designs, layouts, components, and style guides that all teams can use.

- Their cloud platform also enables freelancers and agencies to securely access designs within external clients, enabling B2B activities in design.

While founded in 2012, it took the company 3-4 years to refine its core product. The Figma design tool finally appeared in 2015, was fully released in 2016, and was eventually monetized in 2017 (Pro tier) after maturing it with key features like collaboration and prototyping.

Jamin Ball in a early 2021 look at Figma: "In summary, prior to Figma the challenges of designers workflow included: a lack of collaborative features with desktop apps, version control difficulties, design-to-developer context challenges, prototyping that lived in yet another tool, and a plethora of plugins that were impossible to manage."

Riding the app wave

Figma then rode the rise of web and mobile applications. Figma is primarily a tool for designing, wireframing, mocking up, and prototyping of static web pages and mobile & web apps. However, the flexibility of the visual tool allowed customers to use Figma for a lot of other design-related needs, such as product planning, brainstorming, diagramming, whiteboarding, marketing imagery, strategic planning, presentations, and more. Look through the templates to see what Figma can provide. [More on this when we get to products in part 2.]

Figma is mainly a word-of-mouth, PLG-driven company that sells bottom-up to design teams. However, they then spent the next several years refining their product further, adding multi-team features (the Organizational tier was introduced in 2018), community plugins (added in 2019), and enterprise-friendly features (the Enterprise tier was introduced in 2022). This PLG-driven company has been busy moving upmarket. They enhanced the bottom-up motion with a direct sales org that develops deeper relationships with larger customers.

Figma reminds me heavily of Monday.com, as a successful PLG-driven enterprise SaaS tool with a lot of success from its initial SMB-focused bottom-up sales motion, and is is now heavily focused on moving upmarket into larger enterprises. (See past coverage [paid] of Monday.)

Competitive landscape

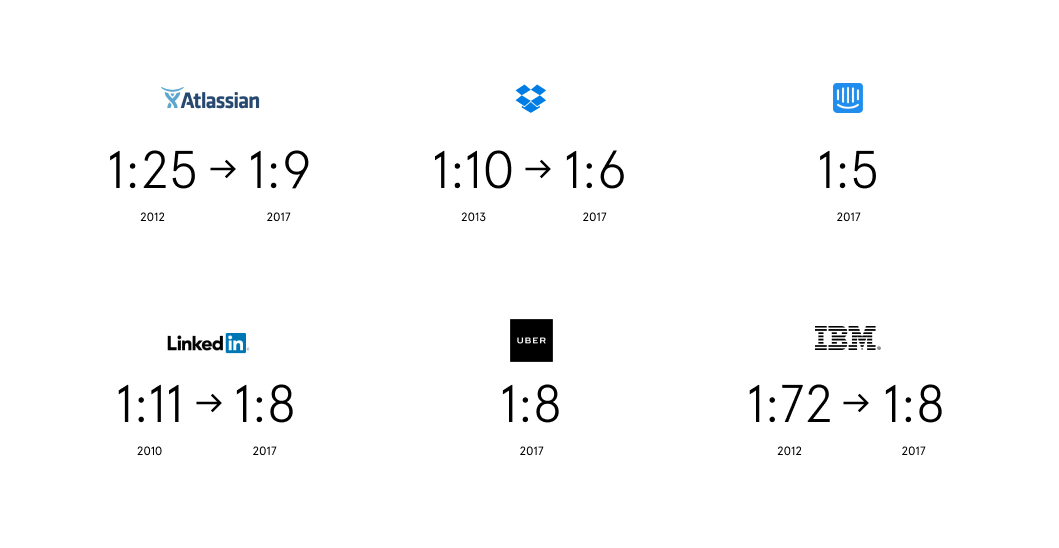

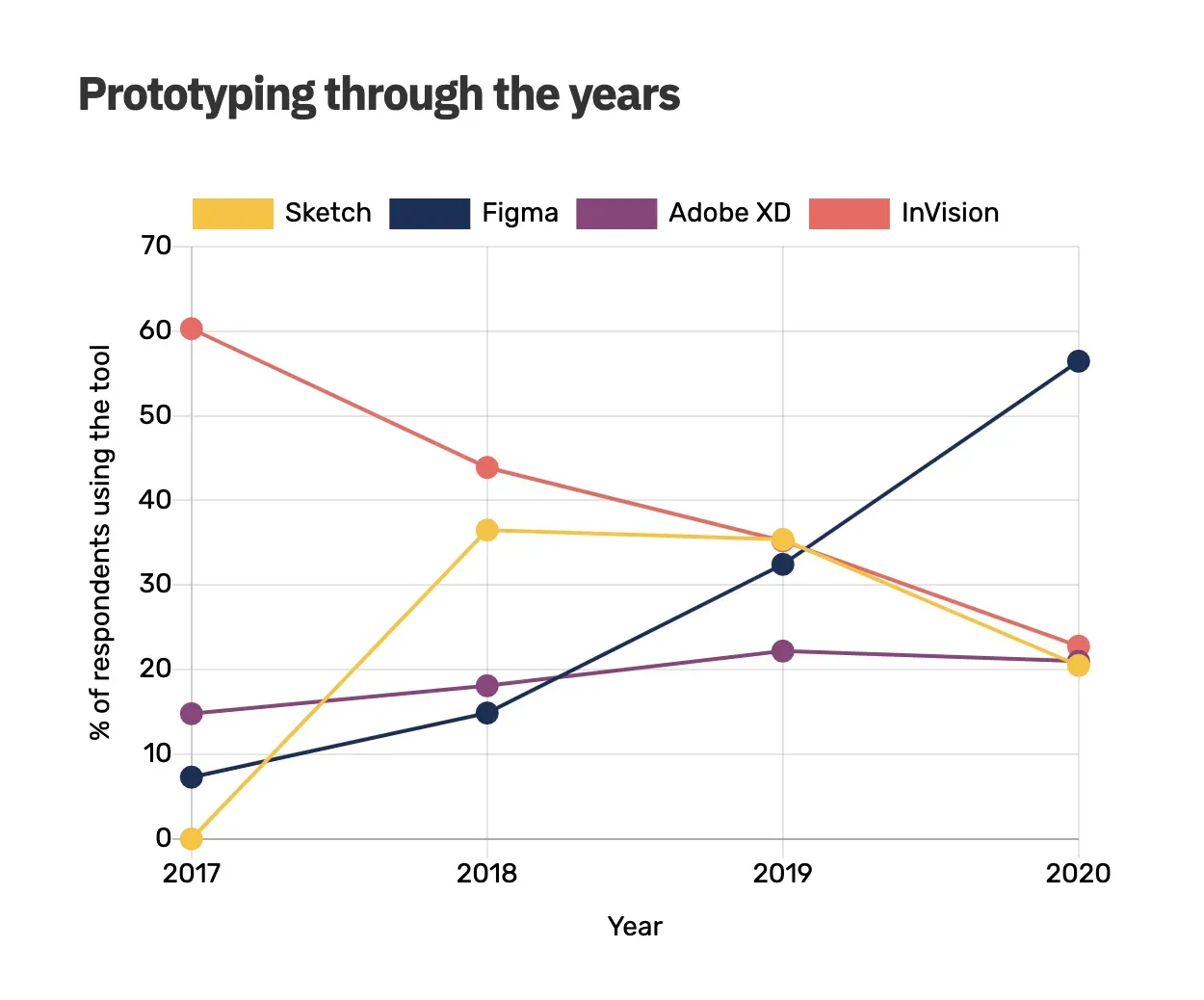

Their primary competition in UI/UX design and prototyping over that time were Sketch, InVision, and Adobe XD. Figma crushed them all. Figma's collaborative team features were very appealing, and as the product matured to feature parity and beyond, teams started to heavily switch away from these other tools.

- One heavily used design tool was the Sketch app, a desktop app on Mac created in 2010 for app designers – which quickly rose into a top UI design tool due to the quick rise in web apps. They later added prototyping features in 2018.

- InVision was a prototyping & whiteboarding design tool that emerged in 2011 – and like Figma, was a cloud-native (browser-based) web app. By 2017, this startup had become the leader in prototyping tools.

- Adobe created an Experience Designer (XD) product in 2016/2017 for app design and prototyping, in order to compete more directly against Sketch and InVision. Like all of their Creative Suite at the time, it too was a desktop app.

Sketch's moves into prototyping seemed to eat into InVision's dominance, and several product and mgmt fumbles caused a rapid downfall from there. One of InVision's problems was performance at scale, and they had to attempt a massive rewrite of their platform that caused a lot of reliability issues. After Miro acquired their whiteboarding features in Nov-23, InVision announced that they were closing up shop in 2024.

Attempted Acquisition

Like Sketch, Adobe's XD was a standalone app, and they were both ultimately crushed by Figma and its collaborative features.

In a big move towards cloud services, Adobe ultimately attempted to acquire Figma in Sept-22. The deal was for $20B in cash and stock, and noted Figma was hitting $400M in annualized revenue in 2022 with an implied growth rate of 100% and an NRR over 150%. It was a staggering sum (50x current revenues), and Figma's CEO founder was all in. To prepare for this, Adobe soon discontinued its competing XD product.

Stratechery had a really interesting piece at the time (and, one might say, a very prescient one) on how Figma was inverting Adobe's dominance. [More on this in part 2.]

"Sketch was not a disruptive product: it was, like Adobe’s products, a desktop app; it just delivered a solution to an emerging product category that Adobe was slow to respond to. Figma, though, was something completely new: the company, which was founded in 2012, made a bet on the browser and spent a full four years building v1 of the product. ... It was the epitome of leveraging new technologies to compete on a new vector, which in this case was collaboration. ... Sketch definitely made it easier to design an app in one place, but it did nothing to make it easier for teams to work on an app together; Figma, because it was native to the web, effectively got collaboration for “free” from the beginning.

... Figma’s photo-editing tools are rudimentary and not remotely competitive with Photoshop; it’s vector editing tools are a bit more advanced but still nowhere near the capability of Illustrator. An app maker may use Figma to place a logo or photo in the application, but the actual creation of that logo or photo still happens in Adobe’s products. Sure, XD is getting killed by Figma, but no one ever subscribed to Creative Cloud for XD; you just used it because it was there.

Here is the problem, though: to the extent that Adobe’s products were being used as part of a Figma workflow was the extent to which Adobe was slowly but surely losing control of its long-term relevance. Figma could, for example, start investing much more heavily in its photo editing or illustration capabilities, rendering Adobe’s products increasingly unnecessary. What is more threatening is Figma’s platform capabilities: 3rd-party developers can build plugins for Figma that make it possible to easily add the sort of editing capabilities that Figma itself lacks, for example.

... This is a world where Figma is the operating system for design, and applications like Photoshop and Illustrator are reduced to plugins, and increasingly commoditized. That, by extension, is exactly what Adobe is buying: control of the key integration point in the design pipeline, and, one would assume, a favored position for Adobe’s own apps in that pipeline."

Fast forward a year, and things were not looking good. EU regulators were balking, and Figma was busy creating explainers on the competitive landscape and the "synergies" of being gobbled up by a giant tech company. Adobe already dominated in Creative Cloud (photo editing, illustration, video editing, audio editing), and the EU was uncomfortable with them now owning the leader in website and app design.

Typical corporate M&A word salad from the explainer post: "Figma’s focus is collaborative product design and development. Adobe builds world-class creative tools that reach hundreds of millions of people around the globe. By bringing our complementary strengths together, we have the potential to unlock new benefits for consumers that neither company could deliver on its own."

By Dec-23 (a month later), the merger was called off after being in regulatory limbo for over a year. This had a big impact on the financials, per the S-1.

- Adobe paid Figma a $1B breakup fee.

- Figma was also hit with over $115M in expenses and $181M in taxes.

- In order to allow existing equity holders to exit, Figma had a new 2024 RSU grant and a subsequent tender offer. This increased SBC expense by $801M.

These are all one-time impacts, and mgmt is adjusting these out of non-GAAP measures – including a separate adjusted FCF to ignore the termination fee.

Domination

Figma has completely dominated the market in UI/UX tooling. Customers include a who's-who of major app brands, including DoorDash, Netflix, Stripe, Duolingo, Hulu, Airbnb, Asana, Atlassian, Coinbase, Dropbox, GitHub, Herman Miller, Microsoft, NYTimes, Slack, Vodafone, Walgreens, and Zoom. They note having 95% of the Fortune 500 as users, and 78% of the Global 2000.

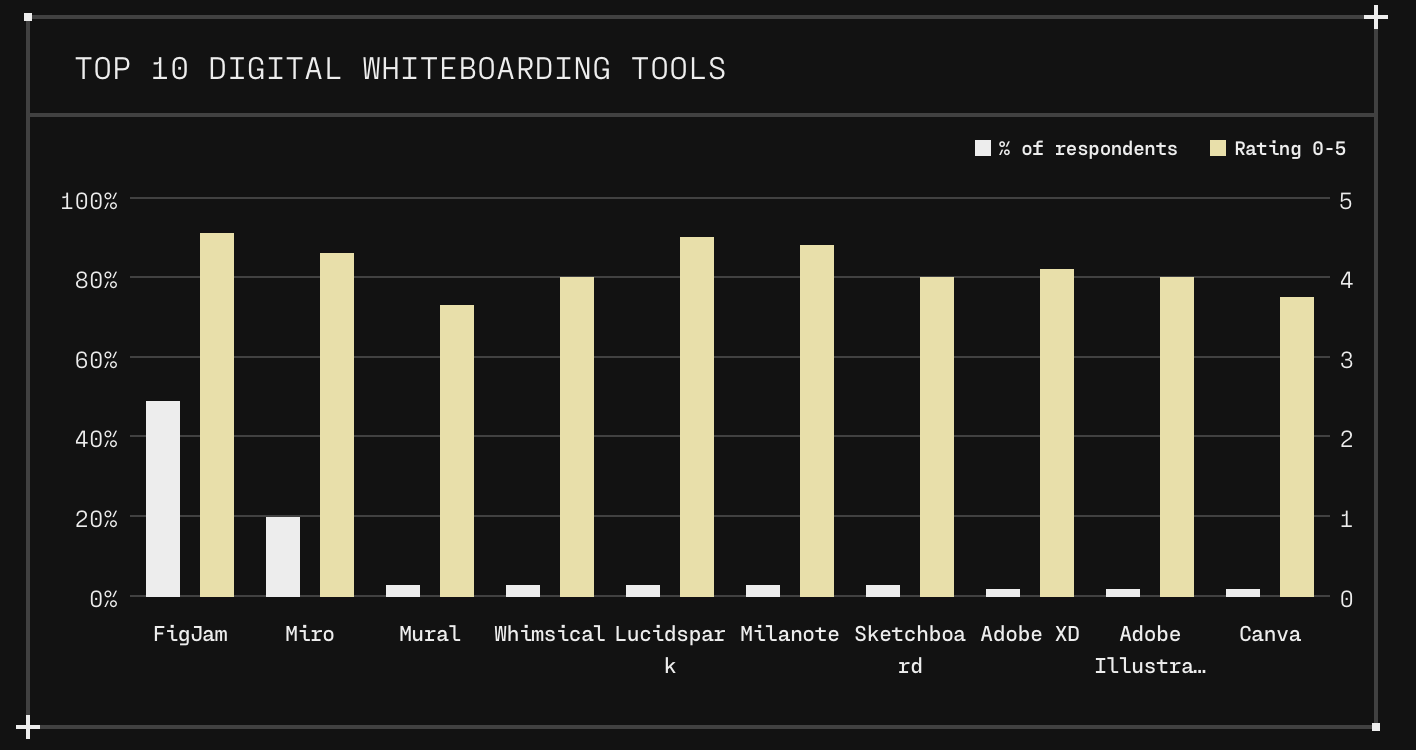

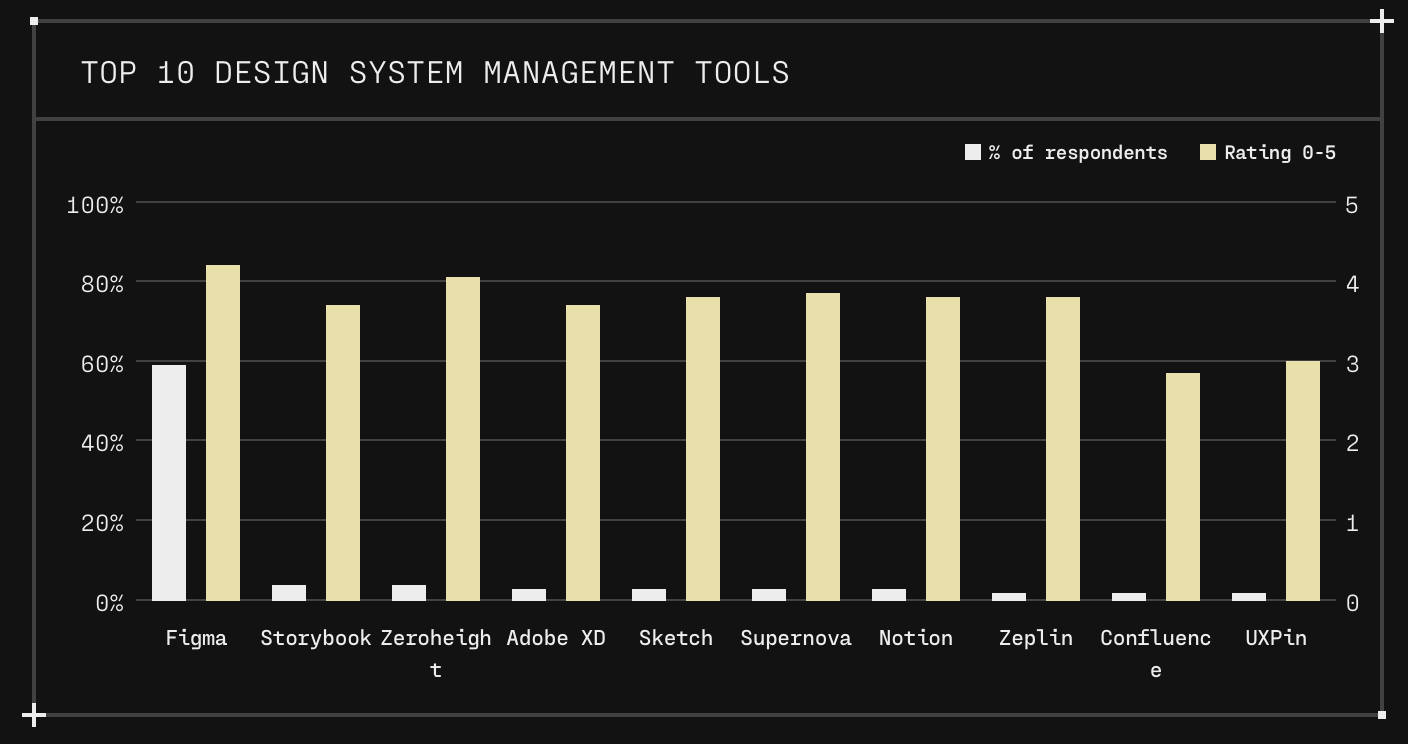

A recent survey shows they maintain this dominance in 2025:

- Figma has an 82% share in UI Design tools

- Figma has a 71.4% share in Basic Prototyping

- Figma has a 48.8% share in design whiteboarding

- Figma has a 59.2% share in design system mgmt

Sketch had "the most comprehensive tool collapse in modern design history" per the survey, though I feel InVision gets a nod for that as well.

Spreading its wings

Another area that Figma is excelling is in spreading the personas using its platform. Beyond the UI/UX design teams, it is being heavily used by non-designers too – across product managers, website builders, mobile & web app developers, decision makers, marketing teams, and copywriters.

And like Monday.com, they are monitoring how their flexible product is being used, in order to spin out new products. Beyond all that success from their core Design tool, Figma is spreading its wings further, and has been shifting from a single collaborative design and prototyping tool into a full suite of design tools in a multi-product platform.

More on their emerging product portfolio and AI moves in part 2, as well as a deeper breakdown of their GTM levers.

Add'l Reading

- Highly recommend Ben Thompson's take on the Adobe acquisition in Stratechery that was quoted heavily above.

- Jamin Ball of Clouded Judgement looked at Figma back in 2021.

- See takes on the rise and fall of InVision here and here and here, and on Reddit.

- Friend of the blog Aakash Gupta wrote up the founder history on LinkedIn. "At this point, Figma is just competing against itself and widening the moat."

- Friend of the blog Contrary Research (private market research) has looked at Figma in depth, including this 2023 deep dive on the evolution of design to shape digital experiences, and how it propelled Adobe, Figma, and Canva.

-muji