As has been typical of the past few Qs, the market is full of drastic reactions to the ebbs and flows in the earning results from software companies, where any stumble or emerging issue is causing a stampede out. So how about a company with 3-4 new issues? Answer: a massive 40%+ drop.

Join Premium for insights like this every week across AI & ML, Data & Analytics, Next-Gen Security, DevOps, and the hyperscalers. I just covered Zscaler, Samara, and Snowflake recently, with coming posts on announcements from Snowflake's recent Snowday (serverless AI inference and more) and CrowdStrike's Fal.con in Sept.

Confluent announced its Q323 results in early November, and the market was not happy with any of it – selling off over 40%.

- Confluent had to reset expectations after 2 customers had major consumption impacts (partial in Q3, fully in coming Q4) and recent geopolitical events. These events caused them to lower their FY23 guide.

- Add to that how they plan to rework the GTM structure in their Cloud segment to focus on driving consumption, and it all led to a low preliminary FY24 guide of +22%.

- Q3 wasn't all bad, as their profitability metrics continued to greatly improve. However, another flag that emerged is a huge slowdown in their new and large customer adds.

Confluent's Q323

Confluent's latest Q was a complete mess. The immediate reaction to their PR was likely to their FY guide reduction (something we've seen over the past year in names like Snowflake, Cloudflare, and Datadog [all paid] as macro changed customer sentiment and buying patterns). But in the conference call, we got a stream of bad news and worse answers. So much so that it felt like mgmt decided to stuff all the bad news into one Q. (If you are having 2 headwinds leading into the next FY, why not add a third!)

The big negatives:

- Q3 had muted top-line numbers due to 2 major Cloud customers curtailing their usage, and the coming Q4 will be more fully impacted. One gaming customer repatriated major cloud workloads to their own data center, and as part of that, are shifting from Confluent Cloud to open-source Kafka. Another customer is curtailing consumption as they are being acquired. They also noted growing geopolitical issues affecting the consumption of Israeli companies.

- These factors caused a lowering of the FY24 guide by -$3M, after just raising it +$7M the Q before [paid]. The CFO stated the 2 companies with shifting usage patterns were ~50% of that shortfall.

- They decided that the macro has shifted buying patterns so much (with companies continuing to avoid pre-paid commitments) that they want to now fast-forward some drastic GTM changes to align it more with their Cloud side (46% of business). At its core, they are aligning sales commissions in the Cloud to be 100% based on consumption instead of the current 10-15%. However, this involves a drastic reworking of their internal tracking & metrics around pipeline & financials, which will take at least 3Qs to work out.

- This has all led to a preliminary FY24 guide of +22% growth next year, impacted heavily in 1H, then strengthening in 2H. The new CFO foresees them eventually regaining a 30% level of growth as tailwinds from Flink, coming planned products, FedRAMP, and AI all more fully kick in.

- Add to all this a big slowdown in their customer additions. This makes me think there are other issues beyond just the near-term rockiness that was customer- & macro-specific. I hope these new GTM motions are focused on this.

The few positives:

- Despite the quickly lagging top-line growth, their profitability has continued to improve as they maintain discipline around their own spend.

- Platform (licensed revenue) continued to show strength in heavily regulated industries like financial services and Federal. This is helping bolster revenue as license revenue is recognized ~20% upfront. (The coming Q4 is typically the biggest Q here, but has a heavy compare).

- This points to the strength of their hybrid model, where Cloud helps smooth the cyclical nature (and heavier upfront revenue recognition) of Platform, and Platform now shows itself to help smooth any big pullbacks in consumption.

Q3 numbers were partially impacted by those 2 customers changing their consumption patterns, but weren't that bad thanks to continued strength on the Platform side. The problem is in how Q4 will get the full brunt of the Cloud consumption shortfall. Subscription revenue grew +36% or +7.3% seq, and Int'l grew faster at +43% (to now 40% of rev). Platform overall grew +19%, while Cloud grew +61% (to now 46% of rev). RPO continued its weakness, with cRPO growing only +4% seq, a level they normally only see in the seasonally weak Q1 [and is likely the big reason for their GTM revamp].

Profitability metrics remained impressive, continuing the massive shift towards breakeven they have pushed over the TTM. Gross Margin improved +5pp to 76.4%. Op margin improved +22pp to -5.5%, and FCF margin +23pp to -6.5%. Mgmt continues to assert that op margin will be breakeven next Q. Despite these advancements, they are nowhere near Rule of 40 (TTM) due to their drastically dropping top-line. FY24 was forecast for breakeven op margin, with a ~2-3pp headwind from their commission change. It should then resume towards their targets of ~5-10% in the midterm and 25%+ longer-term margins.

However, a new red flag in the KPIs was the extremely weak customer adds. They only added +80 net new customers, their lowest ever besides the "reset" Q (when they revamped pay-as-you-go trials to not be included in Q222). Despite the continued strength in NRR, they also only added +41 large customers (after peaking at +84 two Qs ago). This was not really addressed in the conference call given the other dueling issues above, but there may be more going on in GTM beyond the lack of longer-term commitments (RPO). (Their GTM changes do seem focused on improving new customer adds.)

Mgmt kept talking their way through the immediate challenges in the Q&A, but the points they made were never particularly clear. Translation of it all: It's going to be a painful next 9 months. They believe they will emerge through FY24 stronger, with tailwinds from their coming Flink (a new layer of consumption), FedRAMP approval, and AI driving more data usage and a re-acceleration.

Repatriation!?

The biggest shock was how a major gaming customer decided to do a huge repatriation of cloud-based app stacks into a private data center. There was a lot of concern on the call about whether this signals a trend, but the CEO dismissed it.

Epic Games is also a known customer, who is also a big AWS customer. Perhaps they are now doing a major cloud repatriation? However, they were noted as having shifted recently into AWS Local Zones in early 2023. It would take a lot of data centers (essentially building your own edge network) to continue to have low latency across the globe.

CEO in Q&A: "So yes, like you always hear a little bit about this like move out of the cloud. And by and large, we don't see it, maybe in the history of the Company, I could say one or two examples where that's happened. But yes, I don't think it's a broad-based trend. It's definitely motivated by cost. When you think about the kind of pressure on IT budgets, it's far and away the most significant in the digital native sector. These are companies that, in some cases, are cutting 30% of spend. And so, that means very significant adjustments. In this particular company that is coupled with the strategy of moving stuff out of the cloud into their data centers, and Kafka and Confluent kind of gets dragged along with that. We're in discussions with them on Confluent Platform, but that kind of overall shift is not something that's Confluent specific, it's part of a broader strategy."

Later in Q&A: "Every year, you hear about some example, companies selling private cloud stuff, put it on the front page of everything to make a big deal to how the cloud is over. That's not really what we see, like broadly, when we talk to our customer base, including the digital natives. I don't see a big movement there. I do think you see a lot more optimization of cloud, the usage of public cloud, that's certainly happening. But I don't see a big move out as being realistic.

... We obviously sell across both cloud and on-premise. So to some extent, we're like a little bit agnostic. I personally as a technologist, just don't see it as a likely trend. I did this analysis internally when I worked at LinkedIn, I didn't think it made any sense. We were using the public cloud. Public cloud has gotten cheaper since that time. So I don't think it's likely, but obviously, either way, we're happy to work with the customers."

So clearly, this is a drastic shift by a major customer. However, I think what exacerbates it for Confluent is that the customer is moving to open-source Kafka as part of this move.

Q: "One clarification on the gaming company that you're talking about. Can you help me understand was that company on committed contracts that move to open source, committed contract moved to Confluent self-managed? What was the transition exactly?"

CEO: "So, this was a set of applications running out of the cloud running on Confluent Cloud. That's moving into their data center initially on open source Kafka."

So while Confluent's hybrid approach is "agnostic" as to Cloud vs its self-managed enterprise edition (Platform)... that matters little if the customer is ripping out Confluent to shift to open-source. That also makes it seem like this was a direct decision by the customer instead of Confluent getting "dragged along" with a broader cloud repatriation. This customer is making some very drastic moves (and I hope to hear more from that customer in a technical blog post on what their choices were). This makes me think there are other factors at play, such as if they are greatly reducing their reliance on Kafka as part of this shift. If it was simply to move everything to a data center, they wouldn't be shifting to open source, where cluster management & security alone can take several employees (easily $1M+ in payroll)!

I agree with the CEO that it doesn't seem a likely path for many companies, and doubly so to go from Cloud all the way back to open-source Kafka. Kafka is a major pain in the ass to manage and maintain (having done so in a past life), which I believe is one of the big strengths of their Cloud offering. However, as tech-forward customers start to hit over $5M in ARR and beyond, this might start becoming a future threat. There seems to be a breaking point where the pain of setting up and continually maintaining your own Kafka clusters becomes an acceptable line item to reduce cloud spend – which seems like a purely financial decision (CFO), ignoring factors like simplicity, maintainability, security, & reliability (CTO, CIO, CISO).

GTM transition

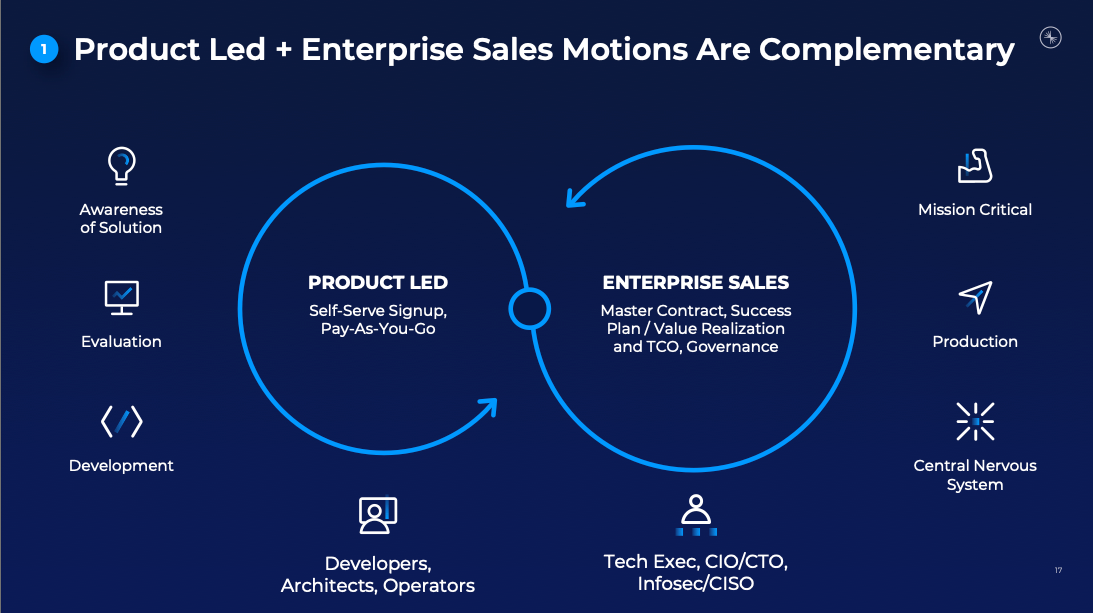

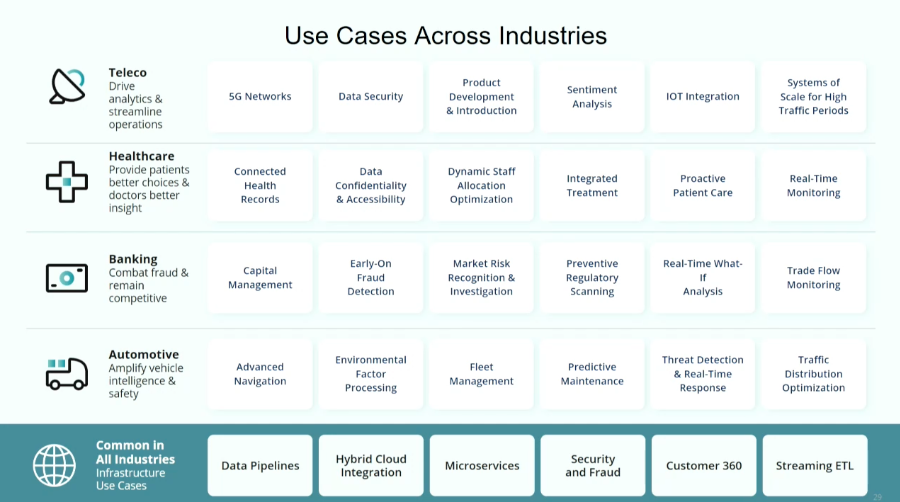

The entire premise of their Confluent Cloud offering is that it is a consumption-based service that can be elastically scaled up and down as needed. Flink is doubling down on that, adding in a new fully-managed service that creates a consumption-based compute layer atop Confluent Cloud for stream processing (for stream enrichment, manipulation, real-time analytics, etc).

Now that Cloud is nearly 50% of the business, it does seem like a good time to get away from contracted up-front commitments to instead focus on consumption. We've known that Confluent (like many other SaaS enterprise platforms) has been hitting issues over the past year in long-term commits in this rockier macro environment. So I don't find it particularly surprising that the company is deciding to revamp things internally to align with consumption-based companies like Snowflake.

CEO in remarks: "Over the last couple of years, businesses like MongoDB, Snowflake, Datadog and hyperscalers have all transitioned their go-to-market to a fully consumption-based model. In this model, the customer and the go-to-market organization are both oriented around the actual service usage, not the upfront commitment. This fully aligns the customer value realization with the vendor's revenue. Less obvious from the outside is how this completely upends the sales and marketing model.

Pipeline is no longer oriented around maximum customer commitment, but rather new logos and new workloads. Salespeople aren't compensated for getting an upfront booking, but rather for what a customer actually uses, finding new workloads and driving new product adoption. This is an absolute win for customers and also a huge win for [us], who are actually able to grow faster by removing much of the uncertainty and risk from customer purchasing."

Mgmt is basically admitting that their GTM motions built over the past few years (between product-led and enterprise sales) has led them into a corner, and that they finally were doing something about it due to the overly-heavy reliance on pre-paid commitments (RPO). I have to admit that my initial reaction was "Again? Another major revamp?" How many internal shifts does this company need to do in R&D and now S&M? This company seems to always be busy retooling its internals. (See the past Project Metamorphosis before the IPO [paid], then the Kora Engine rework since [paid], and now this major GTM refactor.)

CEO in remarks: "In practical terms, here's what this means. First, beginning in Q1 of FY24, we're shifting from our current model where 10% to 15% of cloud sales compensation is based on consumption to a model where 100% of cloud sales compensation is based on incremental consumption in new logo acquisition. We will keep the vast majority of our customer revenue under a committed contract, as we do today. However, we will not be attempting to get commitments ahead of the usage. Rather committed amounts will be customer-driven as customers choose to commit in exchange for greater discounts. Second, we're fully orienting our field-facing teams towards landing new customers and driving new workloads with customers. Third, we'll be adapting our product and pricing to enable customers to frictionlessly try and adopt new products, enabling easier lands and adoption of new features. Finally, we'll be undergoing a significant reworking of our systems for planning, growth, building and measuring pipeline and forecasting performance as all shifts drive directly off cloud revenue."

- Sales commissions are moving to 100% based on consumption increases (from 10-15%).

- Focus turns from large upfront commitments to driving incremental consumption and pushing new workloads. Their goal of commitments going forward is to get customers to commit to existing levels of consumption for discounts.

- Field teams will become more focused on landing new customers with small initial workloads (instead of commitments), and then working with them closely to then expand into other workloads and use cases from there.

- They will be retooling product marketing and pricing for a more frictionless pay-as-you-go focus.

- They also have to retool all their internal S&M tools and processes for tracking pipeline, sales, and commissions. Mgmt noted they have already instrumented a lot of the consumption tracking systems needed as part of their 3-year plan.

Recall that Confluent's prior CFO suddenly left in August – however, it didn't raise any flags as he was headed to Stripe. Confluent promoted the new CFO from within finance. If you saw the CFO portion of their investor day in June, the now CFO had a section at the end to break down the financial mechanics of their hybrid model (Cloud vs Platform). He clearly knows the mechanics of the company, and my assumption is that this GTM shift was pushed by him to better align around the big differences in Cloud vs Platform. Though having to rework all your internal tools and processes sounds like a major task for someone new to the role.

But ultimately, these are welcome moves. I especially like the focus on driving new workloads. One of my complaints about their GTM is how universal Kafka is and how many use cases it serves, leaving it to the customer to figure out how and where else to use it once they adopt it. This signals better handholding of customers across their adoption journey, to help them understand how to better leverage Kafka within their organizations. Confluent has always struggled with customer education on this front, and I think this GTM shift will lead to customers being better educated and encouraged to try new workloads without a commitment. Once new workloads are in place and stabilized, the customer is then incentivized to go back to Confluent for long-term commits on that new usage for a discount.

But the timing of this shift stinks, as to why now and why so fast (and impactful) a shift. This is a major GTM change that is now being promoted as other bad news sinks in (those 2 major customers impacting things, customer adds dropping). And unfortunately, it all got intermixed in the call and led to muddled messaging.

I felt the CEO's opening remarks (quoted and parsed above) really contained all that was needed to know about mechanics of the shift, but there were a lot of questions with unclear answers as to why right now. I was less than impressed with the repeated attempts at giving answers in the Q&A as to what drove this decision now. Mgmt stated they had an existing 3-year plan to better align Cloud GTM efforts with consumption and have already made a few improvements this year – but gave no mention of this reworking in their recent Investor Day at their Current conf four months ago in June. They just spent a few innovation cycles to do a major platform revamp (in Kora Engine), and we now have to watch them spend a few more cycles to perform major changes in their GTM. While both moves are likely great for the long-term, it all comes at a rocky time, where investor sentiment for these shifts is at a low point. Mgmt kept trying to stress how much visibility this will give into future usage, including one where the CEO and CFO took repeated turns answering – but it was all a jumbled mess of an answer that could have likely been solved by a few slides of changes and impacts.

It sounds like this will take a few quarters to work itself out. The CFO stated the NRR is expected to dip down over this time, remaining over 120% and eventually returning to over 125% once through it. Beyond the turmoil this will cause over the next several quarters (especially as commission changes kick in in Q124), there are a few changes in the financial view for investors to note.

- Per the 10-Q, ARR of customer cohorts (>$100K, >$1M, etc) has been based on commitments, not consumption. There will likely be an adjustment to customer cohort counts in Q124 to shift customer ARR to actual consumption.

- RPO & cRPO were previously a heavy focus, setting a base level of commitment that was then drawn down from. They will obviously still have contract commitments and substantial RPO, but they are now being demoted in importance.

- Mgmt is pushing Subscription Revenue as the primary financial KPI, and demoting the RPO/cRPO. As part of this, all guidance will now be given in Subscription Revenue instead of overall Revenue. (Something that Snowflake does, and is sure to cause just as much confusion.)

- The CFO stated there will be a ~2-3pp headwind to margins from their commission change, but their other ongoing margin improvements offset it. They guided for breakeven op margin for FY24 (+9pp YoY).

Product announcements

They held their Current conference in June, which saw a number of new announcements.

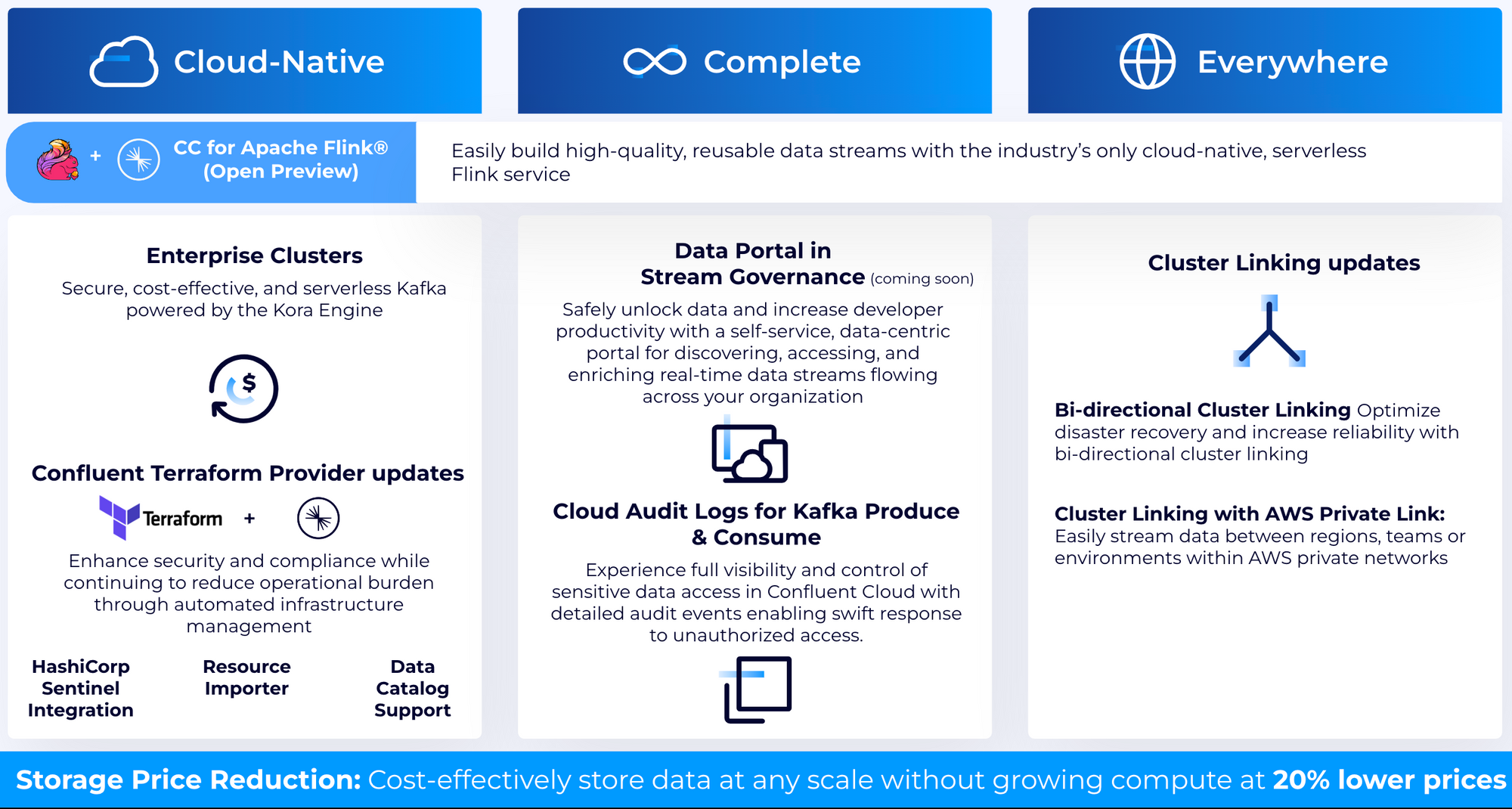

- Their new fully managed Flink service (from the Immerok acquisition) was released in public preview in Confluent Cloud. The interest seems high, with one analyst on the call noting how the Flink sessions at the conference were too packed to attend.

- They announced a new initiative called Data Streaming for AI, to unify their partnerships with major operational and vector databases, cloud providers, and service providers. This also includes a new AI assistant over their Cloud platform, which includes code generation for devs (in both Kafka and Flink). They are also adding the ability to call into AI engines (starting with Open AI) directly from stream processing jobs in Flink. Unfortunately, these new AI features are all way early, and will be unfolding over 2024.

- They also announced a new Enterprise Cluster feature to give customers the level of security & enterprise features within a dedicated cluster, but providing it as an on-demand multi-tenant serverless cluster that customers can privately network into (via AWS Private Link). This is built atop their new Kora engine, and becomes its own pricing tier. This will provide better margins than their Dedicated Clusters (as a multi-tenant service), and provides a good path to transition Dedicated tier custs into consumption-driven.

- Other new enterprise-friendly features include Data Portal (for self-service data discovery and to manage access requests), and bi-directional cluster linking (for higher-end use cases like high-availability load balancing and failover).

- They reduced the storage costs in Confluent Cloud, as of October 1. Mgmt stated that this was to eliminate concerns about data retention, ultimately in order to drive new workloads. This aligns with their new GTM shifts, as well as with Flink (which excels at processing over historical data as well as real-time).

Future drivers

So once we get past the rocky next few quarters, what then? Mgmt pushed on the potential tailwinds a year from now:

CFO in Q&A: "... as we are exiting 2024, there will be a decent amount of tailwinds. First of all, the consumption transformation, which we expect will be behind us and which will reduce the friction between our go-to-market teams as well as how our customers want to buy our products. Second... we'll have a decent amount of product tailwind behind us. We'll have Flink, we'll have GA about 6 months in and a couple of other unlocks from the data streaming platform perspective, coupled with FedRAMP and AI. So we feel that exiting 2024, we feel pretty good with where we are and just in general, from a long-term perspective."

CEO, later in Q&A: "I think probably the biggest thing for us in terms of transformation of what we do is the Flink offering. I mean, that's what brings these application workloads directly into our platform, what makes it so much easier to build some of these things that actually capitalize on streaming to kind of run the logic of the business. In some sense, that's the most exciting, but they actually all play together. Without the connectors that get the data, you don't have the streams to process. Without the innovation in Kora, you don't have the ability to really handle the streaming data across a big organization. Without the governance stuff, it's actually just hard to use this and have correct guarantees around data and reason about it. So they all kind of play together to form the platform. So I think they're all kind of a powerful part of that story."

I agree with mgmt that Flink offers a big boost to consumption from here, which was a big reason I re-entered Confluent with a small position despite the macro headwinds to growth. As I have mentioned before, their managed Flink service is adding an app compute layer directly into Confluent Cloud. I like to think of it as akin to a Lambda service that sits over the streams coming in to and out of the cluster, where customers use serverless functions to perform actions over real-time and batch data streams.

There are AI changes coming here (platform & code assistant AI, and the ability to call AIs directly from Flink), but those are early and likely not in place until later in 2024. [I expect them to show up by the next Current in June]. There were also several mentions of FedRAMP, but I don't see it yet listed as even being "In Process". [They mentioned in a gov event in March that they were pursuing it.]

Add'l Reading

- I previously covered their move into Flink from the acquisition of Immerok.

- See my initial coverage of Kafka and Confluent [paid] at its IPO.

- See the take from their last quarter [paid], which covered the re-architecture of their Cloud platform (Kora Engine).

All in all, 3 strikes in one Q, so the market's response didn't feel like much of an overreaction. But it has since clawed back over 1/2 of that drop. The next few Qs look to be rocky as they retool things, but Confluent ultimately has a good chance of emerging as a stronger company once it gets through them.

Join Premium to read more! I have had pieces over the past few months on Microsoft's moves in security, a Klaviyo platform dive, Google Cloud Next, Cloudflare's Birthday Week, the recent OpenAI saga, Cisco's acquisition of Splunk, and ongoing takes on Samsara, Cloudflare, Snowflake, Datadog, CrowdStrike, Sentinel One, Okta, Zscaler, and more. I will also be covering related moves from the hyperscalers (from Microsoft Ignite and AWS re:Invent) soon as well.

-muji