While I started the blog and Twitter persona in July 2020, I've been writing long-form pieces on investing in enterprise SaaS platforms for nearly 3 years now. But this HHHYPERGROWTH journey is just getting started! My mission with these efforts is to educate myself on what these SaaS companies are building (platform capabilities), how they are executing (overlaying the financial picture over my understanding), and where they are taking it next (technological enhancements and market pivots). And, then, of course, sharing that knowledge with other investors, which in turn helps me gain even more understanding, as I must better organize my thoughts and weave a narrative over it all.

While I normally focus on industry and platform deep dives, it is finally time to write a bit on what I personally look for in my own portfolio. This is primarily to explain the mindset driving my research and why I am interested in the companies I cover. But, of course, a huge side benefit here is to help train investors new to this investment philosophy, on where your eyes should wander as you research hypergrowth SaaS and the financials. So today, let's put aside the tech platforms, and instead take a moment to talk about what drives my investment philosophies – let's look at the big picture and why I invest in hypergrowth.

[Some of these points were originally covered in my FinTwit Summit 2020 presentation in March.]

Exponential Scale

There are a lot of public companies performing well right now, so I try to boil down my interest to the best of the best. I start in the areas of SaaS that are most compelling to me, and overlay what I feel are the top trends. I then research the technology & background of a specific company and its software platforms (understanding of architecture of the platform and the industry, and where it is going), and combine that with the execution story one can find being told in the financials reported every quarter.

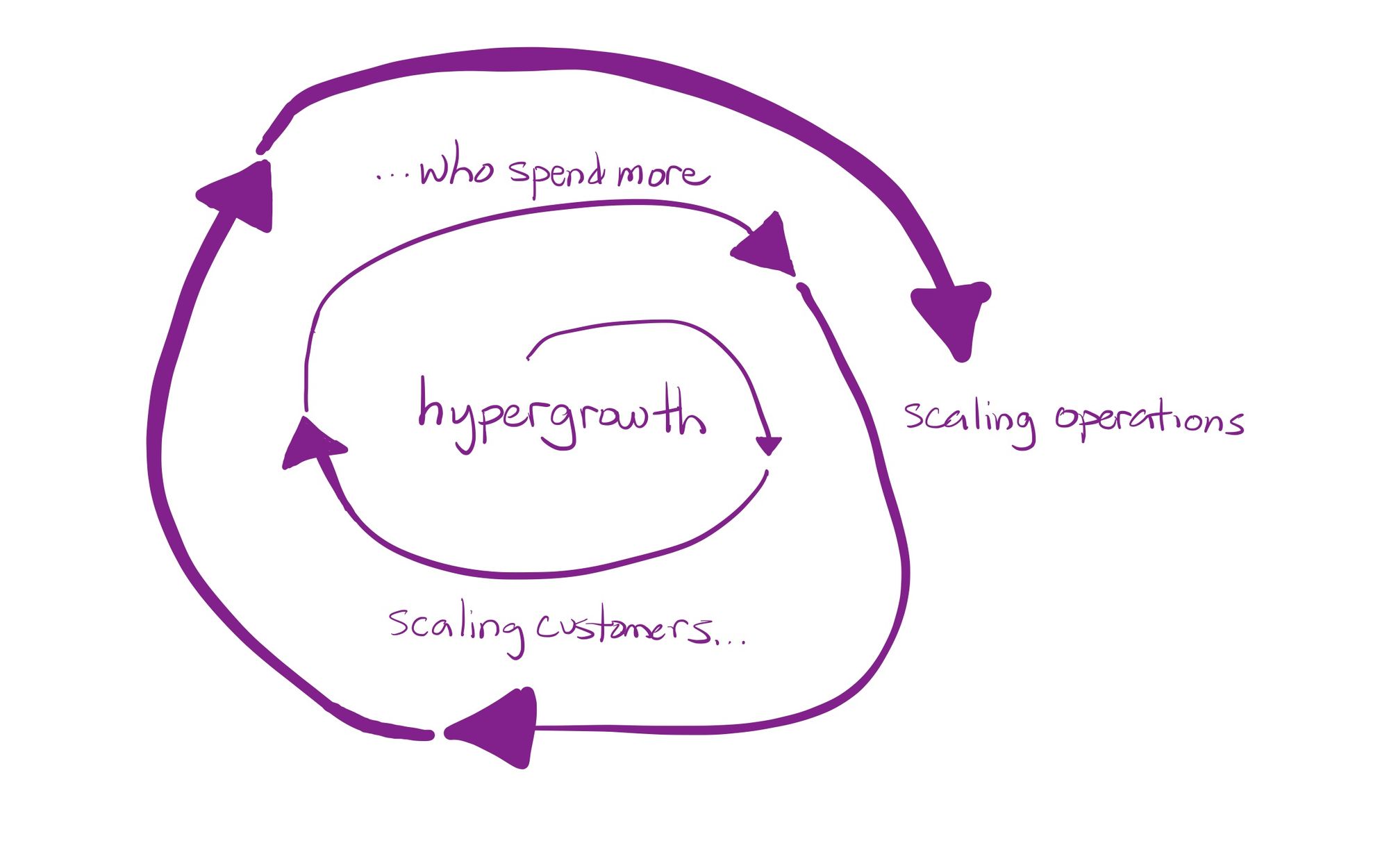

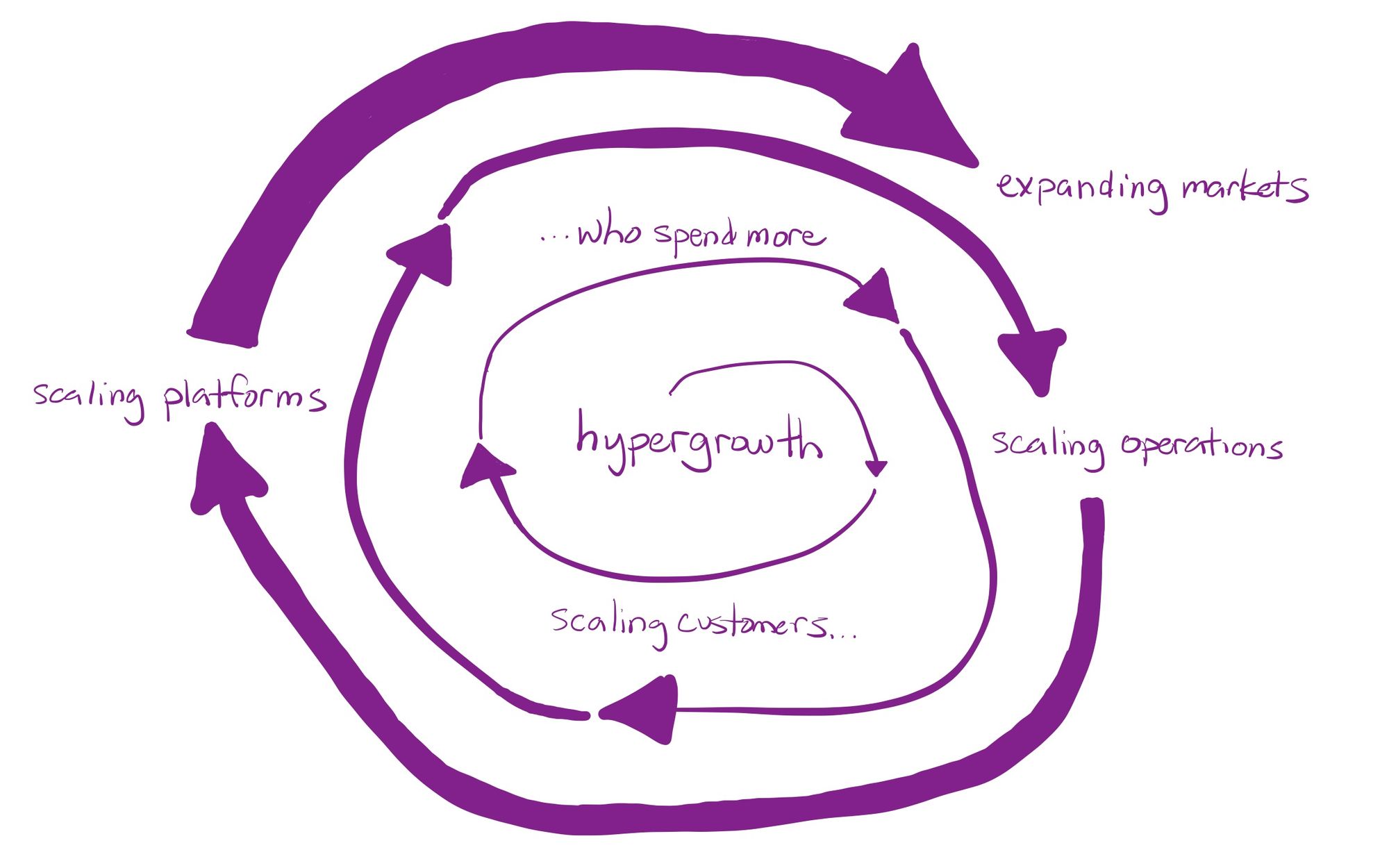

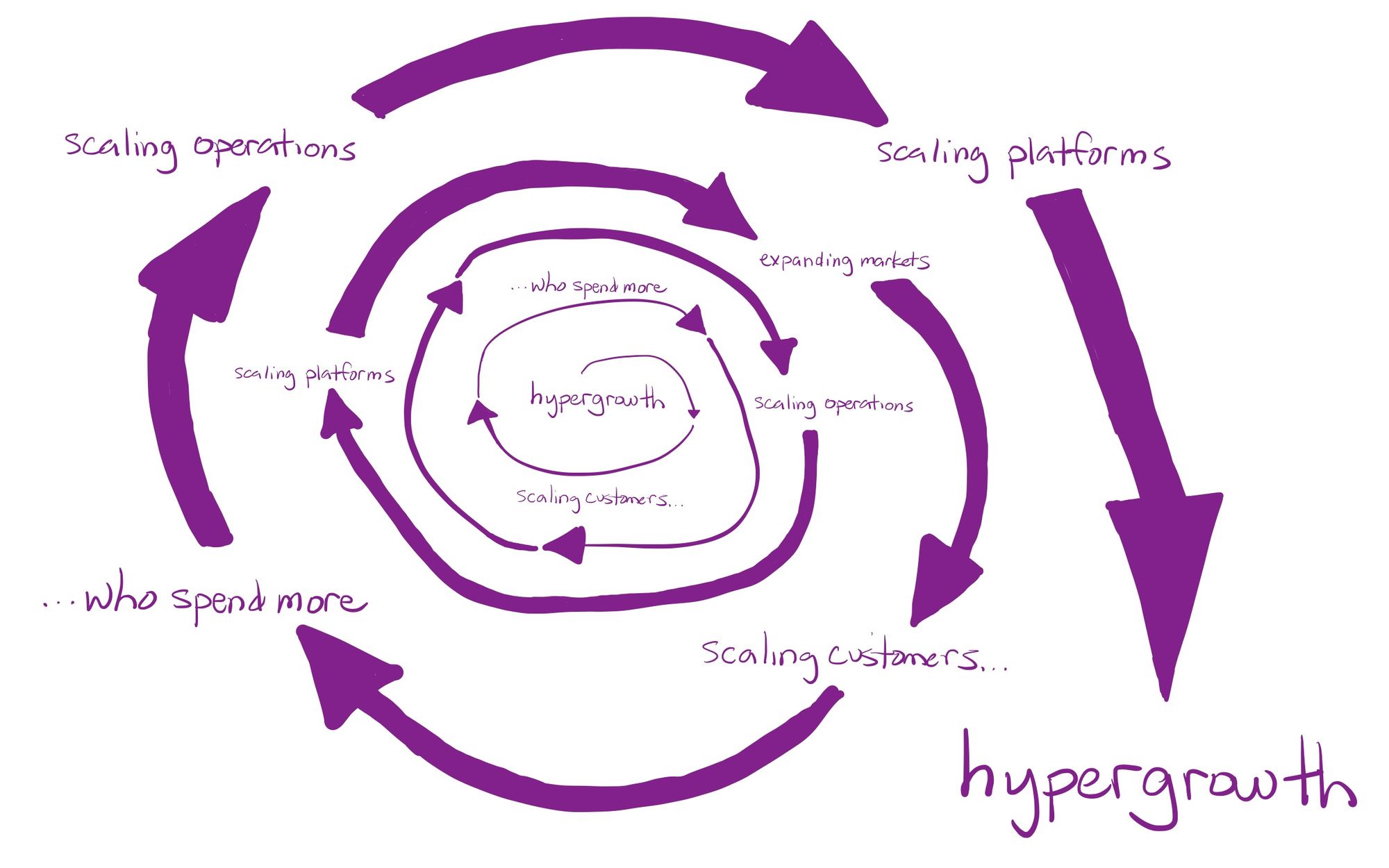

My top 5 boil down to 1) top line hypergrowth, 2) sign of op leverage, 3) do custs flock to it and spend more and more, 4) can operations scale, and 5) potential of their tech/platform. As seen in financials + some educated speculation.

— muji @ hhhypergrowth (@hhhypergrowth) August 15, 2020

Top line hypergrowth is the starting point for me, as it provides proof that the company has a great product that is solving a need for customers, and that has the operational know-how to create and sell it. I set the dial for "hypergrowth" at around 50%, in order to generate a list of potential companies in that spectrum (though that limit can fluctuate). The key from there is about watching a company's ability to scale that growth, first through the financials, then across their platform. I want to find companies that have high levels of growth first at the top line, then have that growth move even faster towards the bottom line (operational leverage). I then want to see signs of further product lines & TAM expansion (optionality and platform leverage), to scale all that up further. This ability to scale throughout the operations and then the platform is the most important trait I seek within my investment thesis -- I want to see revenues scaling, customers & usage scaling, operational margins scaling, the platform scaling, and, ultimately, that all leads to profits scaling.

“The four most dangerous words in investing are: this time it's different.” - Sir John Templeton

Being cloud-native with recurring revenue, with high gross margins, stickiness of services, land and expand strategy, ever increasing virtuous cycles of customer growth and operational excellence, and then having further platform expansions and pivots – these factors all combine to give a company a path to compound success upon success. I don't want to see a company's success go linear, I want to see it go exponential! These factors all combine into greater and greater scale, like a hurricane compounding itself. I WANT TO FIND THE EXPONENTIAL COMPOUNDERS - the category-5 hurricanes of SaaS.

Stages of Hypergrowth

I break my investment research into separate stages - a pre-stage to focus on specific industries, then multiple stages as I dive deeper and deeper into the financials and then the technical platform.

Pre-Stage: Finding the Right Industries

- Wide Applicability = the wider the potential customer base, the better

- Building Blocks = becomes vital tools for companies to build their enterprise upon

- Cloud-native = architected for scale, with the ability to see and react in real-time

- Interesting Tech = where I think the future lies

First off, I tend to stick with enterprise-focused companies, not consumer-focused ones. Consumers can be fickle, price sensitive, and difficult to keep engaged, while consumer trends come and go (fashion, retail, which social network is popular, etc). SaaS providers on the enterprise side get higher price points, more users/usage per sale, and provide consistent use and profits. There is a reason CrowdStrike, Okta, and Zoom all primarily have an enterprise focus, not a consumer one.

Wide Applicability

So why is an enterprise focus so appealing? As I stated way back in my Okta deep dive more than two years ago...

- EVERY company MUST be a tech-driven company.

- EVERY company MUST rely on applications to run the day-to-day operations of their business (whether hosted on-prem or in the cloud, or are using a SaaS provider).

- EVERY company MUST maintain security and monitoring over its systems and its users (workforce & customers), as well as the network traffic between them.

- EVERY company MUST ultimately take advantage of analytics over its data, to better drive their strategy and stay ahead of the competition.

As Okta's CEO @toddmckinnon put it in his Oktane'19 keynote: "You need to be a technology company, or your replacement will be...".

There are lots of different types of SaaS providers out there. Don't make the mistake of lumping all these software-based tech companies together as "tech stocks", or "cloud stocks", or "SaaS stocks". They all have different industries & purposes & markets, and so, in my view, fully deserve their own categories. Cybersecurity is different than monitoring is different than infrastructure-as-a-service is different than payroll is different than video streaming is different than developer tooling. CrowdStrike is nothing like Coupa is nothing like Zoom is nothing like Elastic. SaaS is a delivery device, not a market vertical -- albeit one that creates many, many benefits that drive my investment factors.

At a high level, I like to categorize enterprise SaaS providers into buckets. For starters, I tend to group business operations together into one (which can be further subdivided from there); this means software solutions & tools for the operational side of businesses: HR, Finance, Payroll, Marketing, Sales, Communication, Advertising Mgmt, E-Commerce, Payment Handling, and many others. These all, obviously, have very wide applicability to a huge number of enterprises. Beyond those operations-focused services, however, are the infrastructure-focused ones – which I tend to believe are the more compelling buckets right now. I consider these to be more economy-proof then operational software, so tend to put greater emphasis on them. (Of course, a lot of nuance to that, as the pandemic just proved; E-commerce and communications platforms have done extremely well, even as the economy reeled.)

So my core enterprise SaaS buckets (and their markets) are:

| Bucket | Market Applicability |

|---|---|

| operational software | every enterprise |

| cybersecurity | every enterprise |

| development tooling | App & API Economies |

| infrastructure tooling | every enterprise |

| data & analytics | every enterprise |

Building Blocks

These are the technologies that are having success TODAY and look to have much brighter one TOMORROW. There are, of course, plenty of other industries with a lot of success right now – but I tend to stick to the areas that are vital building blocks to every company. I want the SaaS providers that are providing the tools that enterprises are building their operations and processes upon. (We'll dive more into APIs later.)

Everyone needs cybersecurity, so it has tremendously wide applicability. Every enterprise needs to protect their devices, their servers, their services & apps, their users, their workforce, and their network and its incoming and outgoing traffic. Why bother hiring expensive IT staff and hardware to do things the old way, and have to continually keep that staff trained on the latest best practices and attack techniques? Every company can instead hire the experts to do it for them, and then they can then solely worry about their own core competency, expending their effort on whatever it is that they sell or are building. Going to these providers tends to save a company money, in having to dedicate fewer resources to accomplish the tasks involved. Zero Trust is the area that I consider the next step in where cybersecurity is going, and SASE Networks that combine Zero Trust with enterprise networking. [See my Flavors of Security write up from 2019, if you need an extensive primer on cybersecurity.]

That same cost reduction happens with development and infrastructure services, which serve as the vital building blocks for the companies building software in the App Economy (B2C/B2B) or API Economy (B2B). These services are the "picks and shovels" plays that are benefiting from the ever-expanding app economy, digital transformation of processes, and the resulting need for enterprise interconnectedness; they are the tools that enterprises use to build their own services & apps upon. Enterprises creating and managing software need to figure out where to host infrastructure, how to deliver their services & apps to users, how to monitor all the pieces of it, where to store their data, how to analyze & gain insight from that data, as well as (circling back to cybersecurity) validate and protect their users, and, finally, intercommunicate with them. Developer process tools only scale with the number of developers; I want the tools that scale with usage, so that as the customer's platform gets more popular, the usage of the tool rises. Edge Networks, Communications, Observability and Data Services are a large part of my focus here.

And all companies have a firehose of operational data being generated, so need to corral that data and use analytics over it in order to make sense of it, and to gain any advantage over the competition. My final area of interest is around Data & Analytics, including machine learning (ML) and other forms of artificial intelligence (AI) -- which can cross apply to all the above buckets. It is an industry that is only getting started. Beyond the data & analytical tools making these features available as a SaaS platform to store and analyze operational data, many companies across the other categories are developing and honing their internal use of analytics, in order to strengthen their decisions as well as better secure themselves. And going further, SaaS services are creating more advanced ML/AI features as premium services or that are better honed for specific verticals, so they not only using ML/AI to strengthen their own platforms internally, but are able to directly monetize it.

Cloud-native

The cloud-based providers in these areas have an inherent advantage over legacy solutions. These are industries that move quickly, so the platforms must be properly architected for scale. One key is in having the infrastructure and services be hosted in the cloud. That allows for automating how it scales, allowing both the platform and product lines to handle any gain in sales momentum, and then onward as the platform continues to evolve and pivot from there. Earlier in the COVID pandemic, Zoom scaled to handle 30x the usage over the prior quarter, in a month and a half. Insane!

Hosting your SaaS services in the cloud leads to all kinds of benefits, but I primarily want to first highlight an under-discussed advantage to this centralized architecture – SaaS providers get a global vision over the entirety of their operations and customer base. For cybersecurity companies in particular, this has an enormous advantage over older methods; CrowdStrike, Okta, Zscaler, and Cloudflare get to analyze the security of their entire global network, can analyze patterns across all of their customers and networks at once, and can then respond to attacks and breaches, across all customers, instantly. As one or more customers are affected by an incident or breach, they can fix that issue for all customers at once. This was simply never before possible in earlier solutions! The old methods were network appliances that needed patching, or software you had to install and upgrade on a regular basis to keep up-to-date with the latest attack patterns. This immediacy that cloud-native SaaS providers now have changes everything in how software is delivered and managed. They can update their software & its underlying capabilities continuously, entirely invisible to the end users. They can see everything their customers are doing within their platform, allowing them to project what the usage of that customer will be over the next year, and what to sell to that customer next. [Key to the Recurring Revenue and Land & Expand factors in a bit.]

Interesting Tech

The above all boils down to a set of technologies that excite me the most -- the ones that I feel are best able to leverage the scale, visibility & power of the cloud, are at the forefront of industries that have wide applicability or that drive the app economy, and provide their services as building blocks that companies use to run their enterprises. All of these have incredibly wide applicability, and can be appropriate for ANY company out there. Besides "operational" ones (dealing with customers or sales), those marked "development" are developer-facing tools fed by the App & API Economies, and "infrastructure" are IT-facing tools for providing and protecting the backbone of an enterprise network and its systems.

| Industry | Audience |

|---|---|

| Zero Trust & SASE Networks | infrastructure |

| Edge Networks | development, infrastructure |

| Observability | development, infrastructure |

| Data & Analytics | operational, development |

| Communications | operational, development |

| Fintech & E-commerce | operational, development |

So now that we have the industries I typically focus upon, let's find the market leaders.

Stage 1: Finding the SaaS Market Leaders

- Industry Winners = category killers or disruptors only

- Proven Execution = must be having consistent success on top-line

- Recurring Revenue = must have recurring revenue (subscription or usage)

- Consistent Hypergrowth = recurring revenue must be growing rapidly, >50% and hopefully much more

Once we've found the industries likely to have sustained growth and wide applicability, it's time to find the winners within it.

Industry Winners

I strongly prefer companies that are killing it in their category, as the clear industry leader on Gartner or Forrester reports, or, alternatively, rising upstarts who have faster growth than the competitors they are leaving behind. I want the disruptors, not the disruptees. Top line growth can be a good proxy for this; Datadog is #3 in industry comparisons (Gartner Magic Quadrants), but is growing faster than the larger and "better" competitors -- 3x faster than Dynatrace and 4x faster than New Relic. You don't have to know anything about how their products differentiate – it is very clear who the winner is right now... the one taking a massive amount of market share.

Proven Execution

I avoid aspirational stories and revenue-less companies; I want to see the proof in the numbers now. The market has its own criteria for what it likes, and stocks and industries and technological advances can easily become stock market fads. I have to see the story come true in the execution; I'll let others invest in the pipe dreams, rebounds, and big gambles. I must see proof that management delivers what they promise, and have to see that the operations they have set up perform to their (and my) expectations. It is crucial to me that the company be executing at a high level. I feel that this criteria greatly de-risks my portfolio. I may not be the earliest investor in the company's story, but no matter - success begets success. A company executing now shows me a company that can continue to execute going forward. Management, and the operations machine it has constructed, must prove itself.

Recurring Revenue

I solely deal in companies that have a recurring revenue model. I don't want to own companies that have to sell widgets, unless those widgets are somehow feeding a subscription strategy. In selling a physical object, the company has to then make and sell those same number of widgets PLUS MORE the next year in order to have growth, and has then has extra risk factors like supply chains and distribution networks to deal with. None of these are concerns for software-focused SaaS providers, and in having a recurring revenue model, these companies are guaranteed that the vast majority of their customers will carry their usage forward into the next year. Last year's growth is ALREADY BUILT IN; it doesn't have to start from scratch anew each year. Add to that another benefit to being cloud-native – it gives the company a lot of vision and confidence into its own customer growth patterns.

In looking at the numbers, if a part of the company's revenue is not recurring, I tend to not factor that portion of the company into my calculations below. This includes segments like "Professional Services", which may exist only to help customers on-board onto the platform. I focus on the growth and profitability of the segment driven by recurring revenue. There are further line items to understand with the recurring revenue model, such as Billings, Deferred Revenue and Remaining Performance Obligations (RPO). I track those too, as those are ultimately what feed into the Revenue line in subsequent quarters. But there is a lot of nuance within them, which depend on factors like the average contract length that customers are signing up for, and if they pre-pay. I tend to keep it simple by focusing most on the subscription revenue, keeping an eye on these other metrics to assure they are consistent or growing.

Consistent Hypergrowth

This all then feeds into the final criteria in this stage – the company must have that recurring revenue growing at hyper-speed. After all this, does the company have proven hypergrowth (>50%) right now? Best of all is hypergrowth that is accelerating -- that really gets my attention. Consistent or accelerating hypergrowth shows that the sales & product operations are stable and continually improving. Consistent hypergrowth is proving the product team can create new products that solve a real need for customers, and that the sales & marketing team can sell it.

Now... let's see if those operations can scale.

Stage 2: Finding Scalable Execution

- High Gross Margin = company should not have heavy built-in costs, >70% preferred on total or subscription GM

- Land and Expand = customers should be flocking to the platform, and, once hooked, greatly expand their use of the platform - should see evidence of it in the net retention rate

- Product Cadence = the sales and product teams must be in harmony, and new innovation must be ongoing

- Signs of Operating Leverage = signs that the operating and cash flow margins are moving upward, and can ultimately swing at a GREATER RATE THAN REVENUE at scale

These are areas I look at when analyzing a hypergrowth company's execution, by digging into the financials and earnings calls.

High Gross Margins

First off, the company has to show it can take home the profits off of all of that hypergrowth revenue. Gross Margin will show if they have the ability to scale operations. If it is capital intensive, it either has to maintain a lot of infrastructure, or has to pass costs on to the underlying providers it runs upon (what I call the "infrastructure tax"). That ultimately means less profits, and to my strategy, less potential exponential growth. If Gross Margin isn't at 70% or higher already, I at least like to see that it is rising over time, as proof that the company can contain costs and improve its situation over time. The higher this number, the larger the hurricane of success can ultimately become! As mentioned before, if the company has other segments that are non-recurring (products or ancillary services), I will look specifically at the Gross Margin of the recurring segment. [I do make exceptions in my portfolio for "product-to-subscription" cases, but they are never my highest convictions because of it. Pure play subscriptions can ultimately scale more.]

Side note: I always use Non-GAAP adjusted figures. IMHO, GAAP isn't built for modern SaaS companies having recurring revenue, and that have to find alternative ways to pay their workforce and keep them engaged. (Stock based compensation clearly helps attract & motivate a talented workforce.)

Land and Expand

Innovation is the starting line to success -- and lots of companies have that. The key from there is not only having that initial success, but then scaling the success from there. A successful SaaS platform is solving a problem for its customers. This should mean that MORE customers are then flocking to that solution (showing up as high customer growth), while existing customers spend more and more over time (showing up as high net retention rate, or an average spend that is growing, or that top spending customers continue to increase their ARR – and best is all the above).

I heavily monitor Net Retention Rate (NRR), looking for a minimum of 120% -- with some exceptions given for different go-to-market strategies (I may go lower if new customers are flowing in heavily, or new lands tend to have bigger upfront purchases). There are other considerations that I also look at in the sales engine - ease of installation (is the product self installed, or does it require professional services or outside system integration partners?), and go-to-market strategy (top down, where upper mgmt has to approve, or bottom up, where users or developers can directly install it) are definitely factors in how easy it is for the company to gain new customers and how the operational machine functions.

High customer growth coupled with a net retention rate consistently over 120% is evidence of a Land and Expand strategy, which creates a virtuous cycle. More customers means more immediate growth. Those customers then spend more the next year, creating future growth, during which even more customers join the platform. And again... and again – my entire investing thesis is focused on this virtuous cycle continuing on and on, creating more and more scaled growth as it spins. I need the company to scale, and it has to be ingesting more customers, who are spending more and more, to make this work. I DO NOT CARE ABOUT PROFITABILITY AT THIS POINT, NOR SHOULD THE COMPANY. Each customer will become profitable at some point in the future, as the profits for that customer finally exceed the acquisition costs (underlying operating expenses). As the virtuous cycle spins more and more, with customers joining and then growing their usage, there will ultimately come a profitability inflection point for the entire company.

Product Cadence

Companies that excel at Land and Expand are typically creating a platform of services that can apply to wider and wider use cases. The operational engine that drives Land and Expand is from the harmonious relationship between product (creating new product lines & enhancing existing ones) and sales (selling it). The company must show it is continuously improving and expanding upon its platform of services. As the underlying platform expands, the audience that utilizes it can be expanding as well, to fit more and more use cases of customers seeking that solution (new lands). And as more and more new product lines emerge, sales can be upselling it into the existing customer base (expands).

I want companies that use a data-driven, incremental approach to development of new products and for finding adjacent markets. I prefer my companies to be publicly releasing an early stage product to test product fit, and then be iterating over it, improving it with feedback from the customers. That way, the company can better assure it is building something that fits with what customers' need, instead of having that entire process of "product-market fit" happen later (after months or even years of development effort). I find frequent iteration moves the "fit" way earlier in the cycle, to be sure you are solving a specific problem for customers, in a way they want it to work. Doing it later in the process means you are forcing your customers to fit into your platform's internal vision of what that customer needs, versus listening to what the customers tell you.

I greatly prefer companies that show its innovation cycle happening out in the open, rather than behind closed doors, and watch the product announcements closely to get a sense of product cadence. Look for companies that have a regular iterative process around product releases, where you can see new innovations getting announced, going into beta, and then into production. Sales and marketing should be highlighting these new features in blog posts and customer conferences, to get new and existing customers excited about them. Sales should feed back any insights it gathers from customers, boiling them into new ideas for the product teams.

Signs of Operating Leverage

High gross margins and being cloud-native provide the underpinnings for profitability. But I have to be able to see signs that, as the recurring revenues scale, that the cost of operations will come down for every subsequent sale. Profits come later, but I have to be able to see that they can appear when needed. Operational costs must be scaling at a lower rate than the virtuous cycle of recurring revenue that it spins! Leverage means the company is getting more value from its operations for less cost -- the growth rates from all the new customers joining, and the expanded usage from existing customers, has to be growing greater than the costs for the staff & infrastructure to support it.

For tracking operations, I monitor the long-term trends within the operating and cash flow margins, calculating the basis points (bps) or percentage points (pps) of change. These are typically deeply negative in the early stages of a hypergrowth company, but I want to see them steadily increasing, showing that, as the company is executing, operational leverage is increasing rapidly. Typically the revenue hypergrowth starts gradually lowering before you see the swings toward profitability... but eventually, as the company's success scales up, we should start seeing incredible growth spurts in the operating and cash flow margins as the operating leverage starts kicking in. This is a sign of the impending inflection point, where the company can become net profitable at any time. And if you hit profitability across operating and cash flow margins (and, subsequently, net income) while revenue hypergrowth is still accelerating, well, let's just say you found the holy grail – and absolutely want to be an owner of that combination.

A Reflective Pause

Notice something thus far? You don't have to know any of the details about the underlying technologies to get to this point. Nothing in my stage 1 or 2 requires any understanding of the underlying nuances of a company's SaaS platform.

Just understanding how hypergrowth works across the financials, and how to measure it, can get you a huge amount of investment success. Look for companies that are consistently growing recurring revenue over 50% (or rising to it), coupled with high customer growth and net retention rate (>120%) over high gross margins (>70%), that are showing signs of operating leverage (margins improving). These are the companies that are able to scale sales immensely, and their profits moreso. Customers must be growing markedly, while the existing customers must be spending more and more. As long as that virtuous cycle continues, and the operating and cashflow margins continue to improve - you have a successful company that is extremely likely to do well as an investment. Successful hypergrowth companies tend to easily prove the adage that “winners keep on winning”. All without understanding the technologies! That level of execution, as seen just in the financials, clearly shows that the company is solving the problems their customers are having, while saving them money (in workforce time and resources).

One thing you won't see in my strategy is an attempt at identifying a moat, or doing any sort of product differentiation from competitors (i.e. how does Dynatrace differ from Datadog?). As I mentioned before, those are the kind of things you can see in the hypergrowth execution in the financials. Worry about a company's execution today, and where it takes the platform tomorrow.

And what about valuation? I don’t want to own “cheap” companies -- I want the best of the best hypergrowth companies that are crushing it in their category and will continue to. If a stock seems expensive, look into the reasons why. If its execution continues, it will remain expensive. If it looks cheap, there are reasons for that, too. I personally don't portend signals from charts; I don't watch technicals - I watch the technologies. If the company is performing across all factors of my investment strategy, and technology is alluring, I generally just buy.

Stage 3: Finding Scalable Platforms

- Sticky = the company must have its hooks in its customers

- Building Blocks = ... and, even better, acts as building blocks that can directly integrate into customer's platforms via APIs

- Ecosystem of Integrations = from there, are they building a platform that can integrate with partners and directly into customers?

- Optionality = do their existing products have alot of cross-applicability, and can expand usage or gain other user bases?

- Signs of Platform Leverage = can they leverage their technology & architecture into new directions and markets?

- Growing TAM = ... and, with either of those pivots, grow into larger and larger TAM

This is the point I overlay my technological knowledge about the platform architecture and its capabilities (and, quite likely, why you are reading this blog). When I have a company executing hypergrowth that is combined with a really compelling technology story, I increase my conviction heavily. Any sign of the following factors will continue to compound the hypergrowth engine further. This combination is where I find the most success as an investor.

Sticky

Hypergrowth companies tend to embed themselves more and more into the every day operations of their customers — making it harder and harder to be able to migrate off their platform. As mentioned before, they are the building blocks that enterprises are building their operations and infrastructure upon. This is the allure with these types of enterprise SaaS providers – the fact that customers tend to stay customers, and that it may be difficult to migrate off of the platform to a competitor (if one even exists at feature parity).

While looking for services with really wide applicability & demand, I love to find services that I consider "sticky" - which means it is indispensable in the customer's eyes. As long as the platform solves some problem for its customers in a valuable way, they will stick to that vendor due to some combination of 1) it being cheaper and/or more valuable than the alternatives, 2) it saves them a lot of money in resources (staff & infrastructure) and time, and 3) it strengthens their own operations or platform. And, as mentioned before, once a customer is initially hooked (land), I want to see further sales of other product lines (expand) as the customer utilizes the platform more and more or has ever-increasing usage (if the product pricing is usage- or consumption-based). Stickiness of the platform keeps the recurring revenue flowing longer and longer.

Building Blocks (APIs)

The stickiest companies are the ones that allow an easy-to-implement deep hook into their platform's capabilities, through the use of an API (application programming interface). Developer-focused services use APIs as the building blocks that their customers create their software services over. This causes their services to be deeply embedded into their customer's applications & workflows – it is sticky squared.

Platforms are breaking up their capabilities into components that customers can potentially stitch together as needed. If a customer needs to move data or create workflows between tools, they can use these APIs themselves, in order to do custom behaviors that are tailored to their needs. That again greatly increases the stickiness - the customer is getting so much value from a platform that they are coding their workflows and processes directly around it! Customers going to the trouble of deeply integrating are not likely to rip out the core building blocks that their successful software is built upon. (Not without much planning, and some amount of effort and pain.) Examples of developer-focused services are Okta for user identity management, MongoDB for database storage, Zoom for integrated video calling capabilities, and Twilio for handling user communications. The more these services are coded into successful web and mobile applications, the deeper they embed.

Ecosystem of Integrations

APIs can also provide a different kind of stickiness. Beyond breaking up platform capabilities up into blocks (that the customer can stack in whatever order and can integrate into their own internal services and operational tools), APIs can also be utilized to open a platform up to partners. Platforms are developing ecosystems around themselves, where partnering platforms can integrate with an API in order to exchange data, use an outside feature, or integrate workflows & processes together. Entire marketplaces are arising within these ecosystems, where you can sign up for additional capabilities that are provided by outside vendors – all directly integrated within a single service. This allows joining together platforms, allowing customers to cross-utilize features across them in a more integrated way. Okta and Datadog both focus on having a huge number of integrations from outside services into their platforms, while CrowdStrike and Zscaler are deeply integrating co-integrated features, to the benefit of mutual customers.

Optionality

I especially like to see sticky companies further deepening their hooks into customers. Platforms that are built around the concept of separate modules or pricing tiers allow for expanding a customer's usage in different directions. This allows for a customer to upgrade into higher tiers, or to bolt on additional features on top of their existing usage. This type of optionality allows a SaaS provider to create multiple product lines within their core, and in doing so, continually solve related issues for their existing customers. One strategy is in expanding the audience of users from within the existing customers, such as appealing to both operational and developer users. Another is repackaging the core features for different verticals, which opens into new markets and new customers. All this leads to more users and usage, from both new & existing customers -- bolstering both sides of Land and Expand. This again stresses why Product Cadence is so important, with a harmoneous relationship between product and sales teams to drive these new optionality directions.

Signs of Platform Leverage

Taking optionality even further, it is exciting to find SaaS providers that are capable of leveraging their already built core architecture to evolve their platform in new ways - to either expand their use cases, or to easily pivot into related adjacencies. This is a critical feature when looking for those truly phenomenal, long-term winners that are at the vanguard of these next-generational technologies (Zero Trust, Edge Networks, Analytics). Once they build a successful core platform (that is experiencing hypergrowth and showing operational leverage), if they can pivot that core into new directions, it allows for all new use cases to emerge. Companies should be ever-expanding their product lines by leveraging their existing architecture to solve new problems. This allows for entering new markets, with its own separate pool of potential customers.

As mentioned, SaaS providers have a global vision over their entire network, and of their customers' usage of it. They can detect & respond to issues more easily, by watching over the entirety of their customer base at once. That in turn means they can also apply ML/AI analytics over their entire global customer base and platform at once. Companies are making their platforms stronger and smarter and more secure through the use of internal analytics. And taking it a step farther, some companies are able to directly monetize it, by offering ML/AI features to their customers in a higher price tier. CrowdStrike and Okta are two companies with this double-benefit of ML/AI, using it to both bolster their own security, while also exposing it in higher-tier product lines for their customers. Another nice virtuous cycle with ML/AI is that it improves with more and more data, so as these platforms grow and have success, that begets smarter and better analytics.

Growing TAM

The platform architecture that SaaS companies are building should be enabling other use cases that new capabilities and product lines can emerge from. This gives optionality by leveraging their platform architecture into new directions, which in turn allows their overall market and audience to widen. Each step of that further grows Total Addressable Market (TAM). This has the possibility of creating a giant flywheel over the entire company – if they can continue to innovate & pivot into new directions, they can keep scaling their revenues and profits further and further into the stratosphere. This is the special kind of company that you want to own -- the one that can keep re-igniting hypergrowth over and over.

Conclusion

And that, in a long winded nutshell, is not just hypergrowth... it's HHHYPERGROWTH. It is the culmination of all these stages building upon themselves, scaling the company and its execution and its margins and its platform higher and higher. This all combines to give that exponential growth to the profits.

Did you notice that I do not care anywhere above about net profit? I watch for the signs of operating leverage, which give you the glimpse that profits can flow as soon as the company wishes for it to appear. However, under Land and Expand (especially for sticky services), you want the company to gain as many customers as possible, as fast as possible. Profits can wait! You can successfully continue to hold "formerly hypergrowth" stocks after they drop down into lower growth ranges, as long as profits then rise more, and the platform keeps expanding. Or, you sell, and buy the next hypergrowth stock on your list. Rinse and repeat. Hurricane season will always start back up again.

As stated before, it does feel that "this time really IS different". The capacity to scale so rapidly has never existed before the cloud -- SaaS companies are able to grow extremely rapidly, and their cloud-native architecture can scale to handle it. Revenue is preferably all recurring, where companies have an extreme amount of vision into how consistent the payment flow is. They are typically not capital intensive, so have high gross margins. Companies can amass and seamlessly onboard huge numbers of customers, who then spend more and more over time. Companies can then apply operational leverage, so that costs grow more slowly than revenue, further compounding the march towards profitability. The bottom-line profits will ultimately flow – it just depends on when the company wants to turn the operational spigot marked "PROFIT". In the meantime, they should gobble up every customer they can (land), then turn up the operational leverage as customers continue to grow their usage of the platform (expand).

Add to all that the technological innovation occurring. New products are now appearing in these platforms at an insanely rapid rate. Companies are able to pivot their platform architectures into new directions, and are able to break their platforms into pieces that customers can then directly integrate into their own customized solutions. Ecosystems are being created, that allow for a network of partners to integrate with, and to create automated workflows between them. The exponential success can continue on and on.

This really is a whole new investment reality from the days of old. These companies have expensive valuations for a reason, with their ability to scale their architecture, and their ability to pivot it all into new directions and markets once the original success they focused on begins to slow. And it all feels like it is just starting... industry insiders continue to talk about how the digital transformation of businesses, the move to cloud, and now the move to edge, is all in early innings. ML/AI, in particular, is still in infancy. I plan on leveraging my investment thesis repeatedly over the next few decades, as more and more innovations keep occurring.

- muji